Introduction

The United States is experiencing a historic period of load growth and resource demand led by new manufacturing, industrial facilities and data centers. In this context, carbon capture utilization and storage (CCUS) technologies are emerging as a crucial solution – and one of the most cost-effective – to address the challenge of meeting increased energy demand while simultaneously reducing emissions.

CCUS enables large energy producers and industrial facilities, including steel and cement plants, to capture emissions and safely sequester or utilize them in practical applications. CCUS technologies can provide the opportunity to turn emissions into valuable products such as chemicals, concrete and fuel. CCUS is also being pursued by U.S. liquified natural gas (LNG) providers to reduce the lifecycle emissions profile of LNG, and carbon dioxide is being used in enhanced oil recovery (EOR) to reduce emissions from oil and gas production. With global demand for energy increasing, including demand for natural gas, CCUS will play a vital role in reducing the emissions associated with this abundant American energy resource.

The Section 45Q tax credit is the premier federal incentive for carbon capture technology and poises CCUS for widespread adoption. 45Q was a hallmark of several Congressional Republican energy and climate plans, while also enjoying expanded bipartisan support in recent years. 45Q was enacted to increase investment in CCUS and help the technology achieve an economy of scale. Its continued availability is crucial to meeting rising energy demand, utilizing domestic fuel resources, reinvesting in infrastructure, increasing domestic supply chains and reducing emissions.

The Evolution of 45Q

As a performance-based tax credit, 45Q aims to incentivize carbon management projects that capture carbon oxides (both carbon dioxide and carbon monoxide). The credit was introduced in 2008 and was expanded twice, with the latest version enacted in 2022 (see Table 1). Historically, the credit garners bipartisan support, even though its most recent expansion in 2022 was passed on a partisan basis. Since its initial enactment, Republican lawmakers subsequently championed several proposals to expand and extend 45Q, some of which contained provisions that exceeded the ambition of the enacted expansions, such as making the 45Q tax credit permanent.

| Original 45Q (2008) | Expansion under FUTURE Act (2018) | Expansion under IRA (2022) | |

| Emissions covered | Only CO2 | All carbon oxides | All carbon oxides |

| Eligibility | Industrial facilities, including power generation units | Industrial facilities, power generation, DAC; begin construction before 01/01/2024 | Industrial facilities, power generation, DAC; begin construction before 01/01/2033 |

| Credit value per ton of CO2 | Geologic storage: $20 EOR: $10 per ton of CO2 | Geologic storage: up to $50 EOR: up to $35 per ton of CO2 | Geologic storage: $85 for industrial facilities and power plants; $180 for DAC EOR and reuse: $60 for industrial and power plants; $130 for DAC |

| Annual capture minimum thresholds (metric tons, MT) | 500,000 MT | Power plants: 500,000 MT; Industrial facilities, DAC: 100,000 MT | Power plants: 18,750 MT; Industrial facilities: 12,500 MT; DAC: 1,000 MT |

| Credit cap and duration | Capped at 75 MMT, no defined period | No cap, available for 12 years | No cap, available for 12 years |

| Direct pay and transferability | Only the capturing company could claim credit | Allowed owners of capture equipment to claim credit | Direct pay: Full value for for-profit, available to non-profits Transferability: Credits can be transferred or sold to entities without ownership interests |

Sources: Author’s illustration, based on articles and reports from Congressional Research Service, Great Plains Institute, Carbon Capture Coalition, ClearPath, and U.S. Department of Energy.

45Q: Incentivizing Long-Term Investment

CCUS is a relatively nascent technology and not all applications are economically viable at this time. In sectors such as ethanol production, hydrogen production and natural gas processing, carbon capture is quickly becoming economically viable. However, in use cases such as direct air capture (DAC) or bioenergy with carbon capture and storage (BECCS), it faces prohibitively high up-front capital costs. Additionally, carbon capture projects routinely face a lack of sufficient storage and transportation infrastructure, such as pipelines, as well as lengthy permitting timelines for storage infrastructure such as Class VI wells.

Federal incentives like 45Q offset the high costs associated with carbon capture projects, incentivizing investment and thereby speeding up project development. Prior to 2022, 45Q had become an increasingly utilized incentive in the energy sector, but the 2022 expansion of 45Q was designed to increase the opportunity for CCUS in projects that required more than the previous $50 credit to be economically viable. The direct pay and transferability provisions also made the credit more attractive for investment, as they allowed utilities, co-ops and developers to utilize and monetize the credit.

IIJA and the 45Q Tax Credit Are Unlocking Private Investment and Economic Growth

The Infrastructure Investment and Jobs Act (IIJA) and the expansion of the 45Q tax credit for carbon oxide sequestration contained in the Inflation Reduction Act (IRA) provides a significant catalyst to CCUS investment. Of note, IIJA provided roughly $12 billion in funding for carbon management projects, in addition to $8 billion for the Regional Clean Hydrogen Hubs, several of which will utilize natural gas coupled with carbon capture to produce hydrogen. These incentives play a key role in making initial project financing for CCUS more accessible, as well as scaling technologies, lowering costs and enabling deployment.

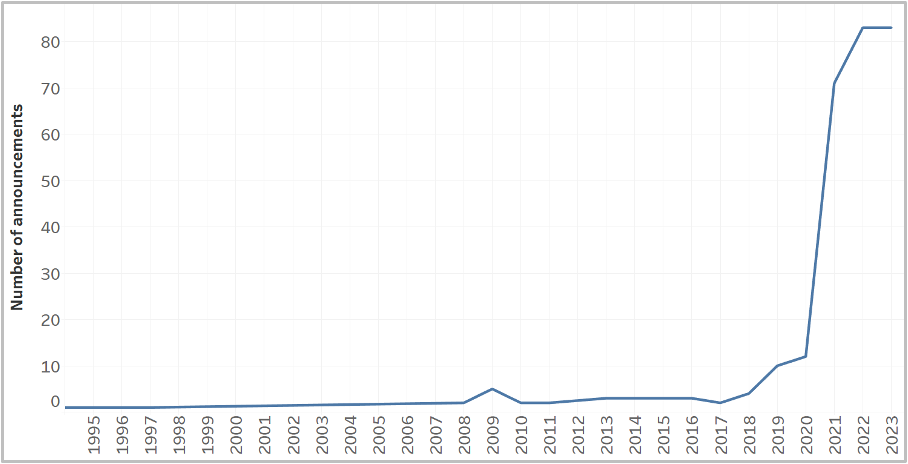

Following the first expansion of 45Q in 2018 and the corresponding release of Treasury’s proposed guidance in 2020 (finalized in 2021), the number of announced CCUS projects in the U.S. ballooned from 4 in 2018 to 83 in 2023 (see Figure 1). Presently, there are 15 carbon capture and storage facilities in the U.S., collectively capable of capturing 0.4 percent of the nation’s annual CO2 emissions. An additional 121 facilities are either under construction or in development, with the potential to increase the nation’s CCUS capacity to 3 percent of current annual CO2 emissions.

Source: Author’s illustration with data from IEA, https://www.iea.org/data-and-statistics/data-product/ccus-projects-database.

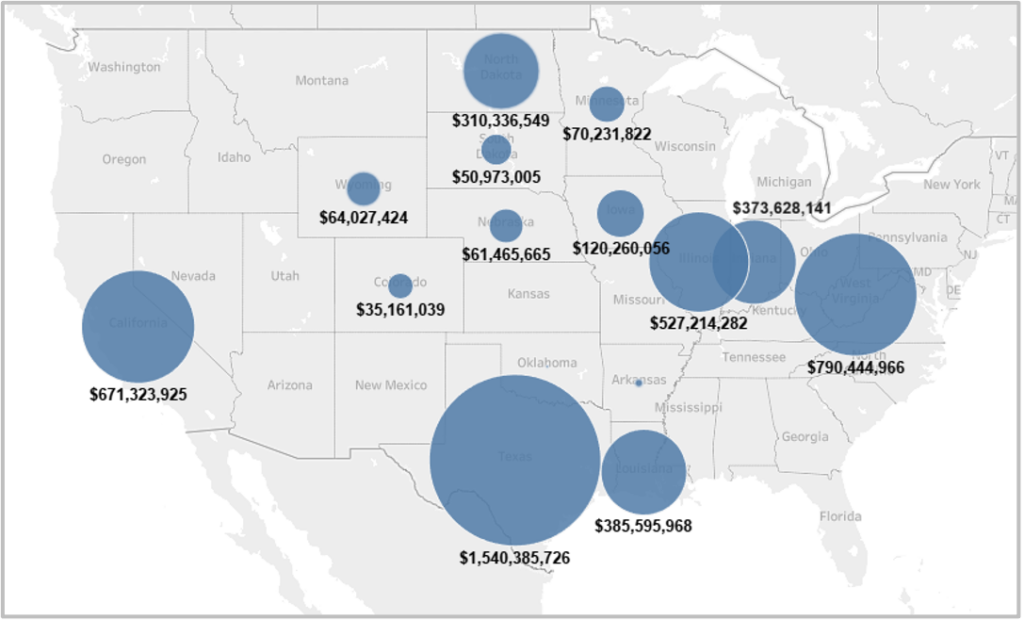

The buildout of the CCUS industry can also spur significant employment and economic growth in the United States. The National Energy Technology Laboratory (NETL) estimates that expanding the CCUS industry could create up to 1.8 million jobs through the construction, operation, and maintenance of capture facilities, pipelines, and storage sites – largely in the Midwest, Appalachia and southern states. See Figure 2 for an illustration of current CCUS investment dollars by state.

Source: Author’s illustration with data from https://www.cleaninvestmentmonitor.org/database.

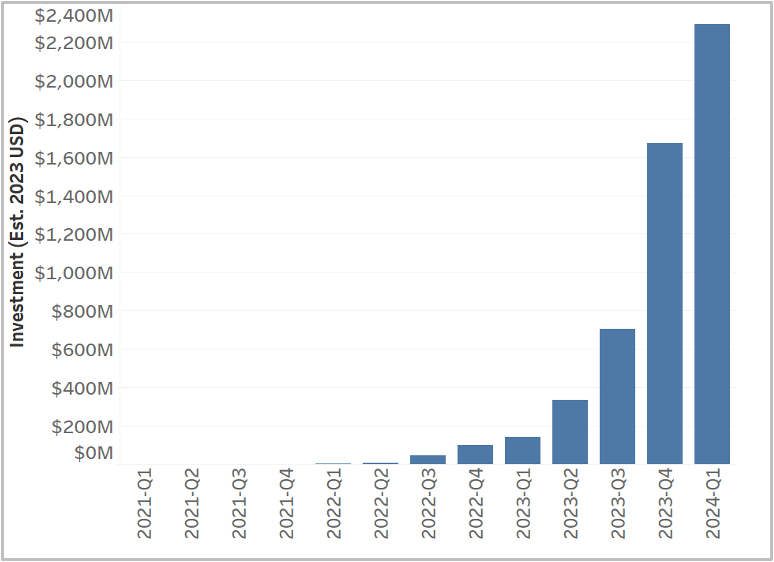

Investment in CCUS has surged in the past two years, with the U.S. Department of Energy (DOE) projecting that the industry could add $600 to $1.45 billion in gross economic value by 2050. Since 2022, investment in carbon capture technologies has increased from $453,594 in Q4 of 2021 to $2.29 million in Q1 of 2024—a 50,000% rise (see Figure 3).

Source: Author’s illustration with data from Database (cleaninvestmentmonitor.org)

Looking Forward

To date, federal support for carbon capture technologies and deployment are catalyzing unprecedented investment. In order to maintain and accelerate investment, developers and U.S. energy producers need certainty and policy stability. Streamlining permitting processes and providing clear permitting timelines related to CO2 storage and pipeline infrastructure would help build this certainty. Furthermore, Treasury should finalize guidance on the expanded 45Q credit as soon as possible, as this would reduce investment risk and allow for better decision-making by developers in the sector. Accelerating the deployment of CCUS technology will ensure critical industries and energy resources can reduce their carbon footprint, and remain economically viable and will boost American global competitiveness.