Introduction

Over the past two decades, the United States transformed its energy landscape by modernizing and rapidly expanding natural gas production. Key technological breakthroughs such as horizontal drilling, hydraulic fracturing and 3-D seismic imaging unlocked vast shale reserves once thought unfeasible. This transformation positioned America as a global energy superpower, with liquefied natural gas (LNG) exports turning abundant domestic supply into strategic advantage. However, intensifying global competition and policy uncertainty raise new questions about how America can maintain and expand its global energy leadership.

LNG is natural gas which is cooled down to the point of becoming a liquid, making it easier to transport over long distances. Today, the U.S. is the world’s largest LNG exporter and a net energy exporter—an achievement few could have predicted two decades ago. This creates a new position of strength, which enhances our national security, lowers emissions and grows our economy. But it is not guaranteed to last. Regulatory and permitting delays, infrastructure bottlenecks, geopolitical rivalries and domestic special interest opposition to American-produced natural gas are putting pressure on America’s LNG advantage.

To secure our goal of energy dominance and meet rising global demand, the U.S. must commit to ensuring a stable, growing LNG industry with a clear strategy to accelerate infrastructure development by cutting red tape, strengthening global market access and future-proof the industry by supporting innovation and transparency.

Building the U.S. LNG Strategic Advantage

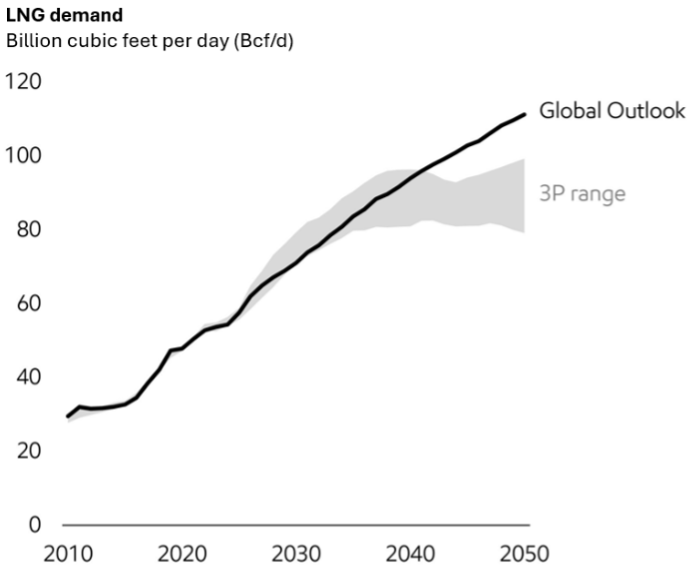

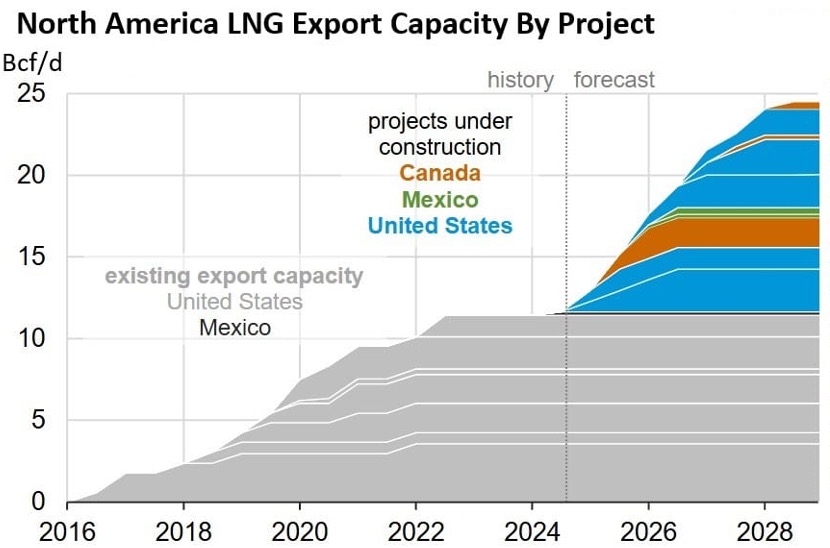

Over the past decade, America’s role in the world’s energy markets has dramatically shifted. In 2016, the U.S. exported its first LNG shipment from the lower 48 states. By 2019, the U.S. became a net total energy exporter, and in 2023, the U.S. surpassed Australia and Qatar to become the world’s largest LNG exporter. According to ExxonMobil’s 2025 Global Outlook, global LNG demand is projected to double by 2050 (Figure 1). To meet this demand, U.S. export capacity is projected to more than double by 2028 from 11.4 to 24.4 billion cubic feet per day (Bcf/d) (Figure 2).

Figure 1. LNG demand is expected to double by 2050. Source: ExxonMobil

Figure 2. U.S. LNG exports are expected to double by 2028 Source: U.S. Energy Information Administration

This high export capacity is reinforced by another key advantage: the flexibility of U.S. shale gas production. Unlike conventional wells, which decline steadily over time, shale wells produce a large volume of gas initially, then production declines sharply. This steep decline curve allows operators to bring new supply online quickly—or pause drilling when prices drop—providing U.S. producers far more agility than competitors in countries like Russia and the Organization of the Petroleum Exporting Countries (OPEC). As a result, U.S. producers can respond more quickly to market shifts and geopolitical events.

American LNG Supports Global Allies

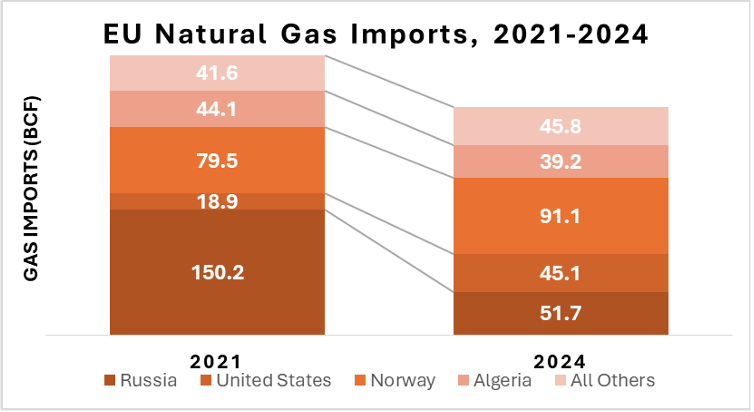

LNG exports provide a strategic advantage in U.S. national security and energy diplomacy, enabling support for allies while weakening the leverage of authoritarian adversaries. Following Russia’s invasion of Ukraine, U.S. LNG became a lifeline for Europe—keeping homes warm and industries running. Between 2021 and 2024, Russia’s share of the European natural gas market plummeted from 40 percent to 11 percent. While Russian imports fell, U.S. imports more than doubled over the same period. By 2024, the U.S. represented 16.5 percent of all of Europe’s natural gas imports and 45 percent of all LNG imports (Figure 3). This is a clear case study on how America’s energy industry can blunt coercion of our allies by hostile regimes.

Figure 3. European imports of U.S. LNG doubled after the invasion of Ukraine Source: European Commission data, reformatted by author

The U.S. LNG industry also serves as a counterweight to other geopolitical energy heavyweights. By offering reliable, transparent and domestically controlled energy, American LNG reduces global dependence on adversaries and provides a foundation for secure energy partnerships. For countries wary of Russia’s politicization of energy exports or China’s increasing chokehold on critical minerals and renewable energy technologies, U.S. natural gas offers an immediate, scalable and reliable alternative.

Energy Diplomacy: How Exports Level the Playing Field

America’s rise as a dominant energy exporter has fundamentally shifted global geopolitics.

As one example, energy in the Middle East has long been a source of geopolitical leverage. By achieving record oil and natural gas production, the U.S. reduced our dependence on foreign imports and thereby diminished the relative influence of OPEC member nations. This created new opportunities to shape international relations. It also reduced global energy shocks that historically occurred with instability in the Middle East. This gives America’s leaders and diplomats greater flexibility and leverage, enabling them to support allies and apply pressure on adversaries with less fear of supply disruptions or price shocks.

This transformation in American energy security stands in sharp contrast to the vulnerability created by energy dependence elsewhere. Europe’s heavy reliance on Russian oil and natural gas provided Moscow with both revenue and political leverage for decades. Energy exports account for roughly 30-50 percent of Russia’s federal budget, meaning Europe’s dependence effectively helped fund the Kremlin’s military buildup and, ultimately, its invasion of Ukraine. This dependence also constrained Europe’s foreign policy choices, as Moscow wielded energy as a geopolitical weapon. The rapid expansion of U.S. LNG exports fundamentally altered this dynamic: by providing reliable, non-Russian supply, American LNG provided European allies the ability to reduce reliance on Russian gas, weaken the Kremlin’s energy leverage and undermine one of its most important sources of funding.

U.S. LNG Drives Down Global Emissions

U.S. LNG is not just a geopolitical tool; it is a critical asset in mitigating climate change. As global demand for energy continues to rise, so does the urgency to reduce emissions. According to the U.S. Energy Information Administration, global demand for total energy and natural gas is expected to increase up to 57 percent between 2022 and 2050. Which countries supply that demand will have a significant impact on global emissions. The U.S. is one of the most carbon efficient producers and exporters of energy in the world. Meeting this demand while keeping emissions in check will require the significant use of U.S. LNG.

U.S. LNG: A Clean Fuel

Since 2009, natural gas displaced coal as the primary energy resource for the U.S. This “intra-fuel switching” resulted in our nation leading the world in greenhouse gas (GHG) emissions reductions. U.S. LNG provides an opportunity to make further emissions progress by facilitating coal-to-gas switching around the world. U.S. LNG can help economies—particularly in Asia and Europe—achieve power sector emissions reductions of up to 50 percent compared to continued coal use.

U.S. LNG is not just cleaner than coal—it consistently demonstrates lower life cycle GHG emissions than competing global natural gas sources, especially in Russia. According to the National Energy Technology Laboratory, Russian natural gas exported to Europe results in 41 percent more emissions than U.S. LNG and 47 percent more emissions when exporting to Asia. However, the gap may be even greater. A 2023 report by Dr. Robert Kleinberg Ph.D. challenges the credibility of Russia’s emissions data, suggesting that actual emissions are much higher.

Just slowing the growth of U.S. LNG could significantly increase global emissions. In March 2025, S&P Global released a study on the environmental impacts of a potential pause on new LNG export permits. S&P Global found that the pause would result in an additional 780 million tons of carbon dioxide equivalents cumulative global emissions from 2028 to 2040. To put these results into perspective, this is 31 percent greater than the total emissions of Germany in 2023, the largest emitting country in Europe.

Data-Driven Decarbonization

In a carbon-constrained world, emissions transparency is a critical competitive advantage, with billions in LNG contracts hinging on credible climate data. In 2020, the French government blocked a $7 billion deal between Engie, a European energy company, and NextDecade, a U.S. LNG exporter. The decision was made due to concerns over GHG emissions related to the deal, particularly methane. While American producers and policymakers knew this to be false, U.S. LNG developers lacked the systems, technologies and protocols to credibly make this case at the time. France’s decision was eventually reversed, and Engie signed contracts for U.S. LNG in 2021 and 2022, ultimately signing with U.S. exporters backed by strong climate strategies and programs. Engie’s initial decision highlighted the importance of transparent and verifiable data for the emissions profiling of U.S. LNG.

In just a few short years, stakeholders throughout the value chain raced to leverage state-of-the-art emissions detection technologies to find and monitor previously unknown leaks and emissions. These technologies enabled the development of new systems of measurement, monitoring, reporting and verification (MMRV) to find and fix methane leaks throughout the natural gas value chain. Thanks to industry-led MMRV initiatives and third-party verification efforts (e.g., GTI Veritas, OGMP 2.0), the U.S. has emerged as a global leader in voluntary methane reporting and emissions reductions. As global markets increasingly demand verified emissions data, this transparency leadership positions U.S. LNG to maintain its dominant market position.

LNG is Driving American Economic Growth

LNG exports are also an important driver of economic prosperity in the U.S., fueling growth, creating jobs and investing in our industrial base. As global demand for cleaner energy rises, U.S. LNG exports are generating substantial economic returns for workers, manufacturers and communities across the country.

According to the National Association of Manufacturers (NAM), the U.S. LNG industry contributed $43.8 billion to the national economy in 2023. This supported over 222,000 direct and indirect jobs and generated more than $11 billion in federal, state and local tax and royalty revenues. Under a high-growth scenario, NAM estimates the industry could contribute up to $215 billion to gross domestic product and support more than 900,000 jobs by 2044, including upstream and midstream infrastructure development.

LNG infrastructure investments also spur demand for U.S.-made equipment—from steel to compressors—bolstering domestic manufacturing. These gains are driven by both upstream natural gas development and the downstream buildout of export infrastructure—each step reinforcing the U.S. position as a global energy leader.

Headwinds, Risks and Challenges

The U.S. LNG industry faces significant headwinds that threaten its ability to meet rising global demand and sustain American energy leadership. Addressing these challenges will require decisive policy action to ensure competitiveness and reliability in the years ahead.

Regulatory Delays & Policy Uncertainty: Rapid policy shifts (e.g., the 2024 pause on new LNG permits) and permitting uncertainty threaten the stability needed for LNG investment. The Department of Energy’s (DOE) export authorization process lacks clear timelines, while the Federal Energy Regulatory Commission (FERC) reviews remain inconsistent and vulnerable to local opposition. Without regulatory certainty, private investment in LNG infrastructure faces unnecessary delays and cost overruns.

Infrastructure & Capacity Constraints: Pipeline bottlenecks limit gas flows to export terminals and complex permitting adds years to critical infrastructure projects. Terminal capacity constraints create supply chain vulnerabilities. Without streamlined development, the U.S. risks losing market share to international competitors, like Qatar, who can bring new capacity online faster.

Increasing Costs: LNG terminals are highly capital-intensive, typically requiring $5-10 billion for mid-sized facilities. Delays, inflation, tariffs, interest rates and labor shortages can sharply increase total costs, undermining the competitiveness and financial viability of U.S. LNG exports.

Market & Competition Risks: Countries around the world are rapidly expanding LNG export capacity to meet the growing demands for LNG. By 2030, the U.S.’s LNG export capacity is expected to more than double from 13 Bcf/d to 28 Bcf/d, nearly 24 percent of the total U.S. natural gas production in June 2025. Over the same time, Qatar will likely boost its own export capacity by 85 percent. Meanwhile, price volatility in the natural gas markets and the global LNG markets create uncertainty for the long-term contracts that LNG projects depend on. U.S. LNG must compete on cost and flexibility, not just reliability.

Environmental Pressures: International buyers, particularly in the European Union (EU), Japan and South Korea, increasingly demand verified low-emissions gas with third-party certification. While the U.S. leads in methane monitoring, emerging emissions management requirements could affect market access.

Opposition to U.S. LNG: Special interest activists continue to falsely claim that American natural gas is an obstacle to addressing climate change, putting pressure on politicians to implement policies that impede U.S. LNG. These flawed actions have already directly resulted in increased global emissions, lost economic opportunity for America, reduced global energy security and increased geopolitical influence of adversarial states including Russia and China.

Policy Recommendations: How to Secure U.S. LNG Leadership

To secure America’s energy leadership and maintain a competitive advantage in global LNG markets, the U.S. must act decisively to modernize its regulatory framework, strengthen market access and support the deployment of clean technologies.

Fix the Process: Permitting Reform & Regulatory Certainty

U.S. LNG leadership is threatened by policy volatility and permitting dysfunction that delays infrastructure and cedes ground to foreign competitors.

- Enact comprehensive permitting reforms to streamline cumbersome permitting processes that often lead to substantial delays.

- Codify the process of reviewing whether an energy project is in the “public interest,” ensuring transparent, time-bound, consistent reviews to preserve business certainty.

Increase Leverage: Expand Market Access and Project Finance

In a world of state-backed energy finance and growing geopolitical competition, the U.S. cannot afford to tie its own hands. Federal tools should strengthen America’s competitive position.

- Ensure U.S. LNG projects are not precluded from accessing financing tools designed to enhance global competitiveness for American businesses, such as the U.S. International Development Finance Corporation and Export-Import Bank.

- Expand U.S. energy diplomacy to help secure offtake agreements, such as those negotiated with the EU and South Korea.

Future-Proof the Industry: Promote Innovation and Improve Transparency

To remain competitive in global markets, U.S. LNG must lead on emissions performance, accelerating innovation and providing transparent, verifiable data to buyers.

- Expand research, development and deployment for MMRV, carbon capture, hydrogen blending and next-generation fuels to keep U.S. LNG assets competitive and future-ready.

Conclusion

The transformation from energy importer to the United States becoming the world’s largest exporter of LNG represents one of the most significant geopolitical shifts of the 21st century. This achievement strengthens national security, reduces global emissions and drives American prosperity. As global LNG demand rapidly increases, the choices we make today will determine whether America maintains its energy leadership or cedes ground to competitors. By streamlining permitting, expanding market access and investing in innovation, we can ensure American LNG continues to power global growth while advancing our national interests. The world needs reliable, clean energy—and American LNG is ready to rise to meet these needs.