Introduction

Section 45X of the Internal Revenue Code (IRC) provides an advanced manufacturing production credit to domestic manufacturers of applicable clean energy components. Currently, the United States relies heavily on foreign manufacturers for these components and resources, including adversarial countries like Russia and China. Establishing a robust domestic supply chain requires reducing U.S. dependence on foreign sources for the necessary supplies and improved investment in locally mined and sourced materials. Growing our domestic manufacturing capacity for these strategically valuable resources not only serves to bolster U.S. economic strength but also national security. The codification of Section 45X aims to address such concerns by ensuring that to receive the tax credit, a manufacturer must produce the identified qualifying components in the United States. The tax credit thus has been correlated to a rapid increase in domestic manufacturing project announcements, which will allow American domestic clean energy and economy to remain potentially competitive.

Qualifying Components

45X is an uncapped per-unit credit, which varies based on the product type and is not subject to a maximum limit in terms of the amount it can be applied towards, encouraging the production and adoption of diverse products. Qualifying components include solar and wind energy devices, battery components, inverters and domestic producers of applicable critical minerals.

Critical Minerals

Currently, China holds a monopoly in minerals supply, processing over 80 percent of rare earth elements, and the U.S. is entirely dependent on foreign suppliers for 12 critical minerals. Critical minerals are crucial in the development of various advanced technologies, including those used in clean energy production. However, given the time it takes to establish mining operations and the environmental concerns that often accompany these facilities and fluctuating market prices, increasing domestic capacity is likely to take years. As defined by the Energy Act of 2020, a critical mineral is “a non-fuel mineral or mineral material essential to the economic or national security of the U.S. and which has a supply chain vulnerable to disruption.” The U.S. Geological Survey identified a list of 50 “critical minerals,” and 45X could cover approximately 10 percent of the production cost of these minerals.

Battery Energy Storage Components

Section 45X covers the production of electrode active materials, battery cells and battery modules. China dominates the market for battery parts, producing 60 percent of battery components and 75 percent of all lithium-ion batteries. The United States relies primarily on foreign manufacturing for most of these battery components. Since Section 45X passed, 14 new battery manufacturing sites have been announced in North America – the fastest growth in planned battery cell facilities. The ability of the United States to domestically manufacture batteries is considered key to the growth of assembly factories and price competitiveness of U.S. markets including electric vehicles, medical devices and utilities.

Wind Energy

Historically, the United States has relied on imports for wind turbine components, mostly coming from India, Vietnam and Mexico. Currently, a majority of wind turbine towers and nacelle assemblies are manufactured in the United States, yet blade and hub components are still largely import-dependent. The 45X credit extends to blade, nacelle, tower, offshore wind foundation and related offshore vessels. Since the codification of 45X, 14 new wind component manufacturing facilities have been announced. The credit is expected to decrease costs by 7.5 percent as the United States bolsters domestically produced components, encouraging high-level domestic content.

Solar Energy

Efforts to incentivize the growth of domestic solar manufacturing can be attributed to concerns about supply chain security, as Chinese-produced subsidized solar products dominate the market. In 2012, the U.S. imposed anti-dumping/countervailing tariffs on imports from China, which was later extended globally. However, in 2022, a two-year freeze on the ban was put in place and as a result, there was a four-quarter consecutive increase of solar cell imports (as shown in Figure 1).

Despite the increased reliance on imports, the tax credit is expected to decrease the domestic cost of producing modules by more than 30 percent compared to the cost of importing modules. Section 45X has been attributed to the announcement of 51 new solar manufacturing projects. Photovoltaic cells and wafers, solar grade polysilicon, polymeric backsheets and solar modules qualify for the 45X credit. It is estimated that by 2026, the U.S. manufacturing capacity for modules, cells, wafers, ingots and inverters will be 17 times higher than it is currently.

Figure 1

Source: Summer 2023 Solar Industry Update (nrel.gov)

Inverters

Inverters are often designed in the United States; however, integrated circuits and semiconductor power-handling components are primarily produced in Asia. Section 45X covers the production of inverters, which are primarily used in the production of solar and wind energy to allow the direct current power produced to be sent to the alternating current electric grid. Section 45X is expected to increase capacity by 7GW within the solar sector, while decreasing associated costs.

Wins of 45X

The 45X tax credit is intended to incentivize investment and increase U.S. competitiveness in the clean energy market including supply chain, technology, power generation and storage- ultimately helping the U.S. be a global leader in clean energy. One year after its implementation, the credit has contributed to significant developments, with 171 manufacturing projects announced in the country. Notably, 28 percent of developers have expressed intentions to establish facilities in clean energy manufacturing.

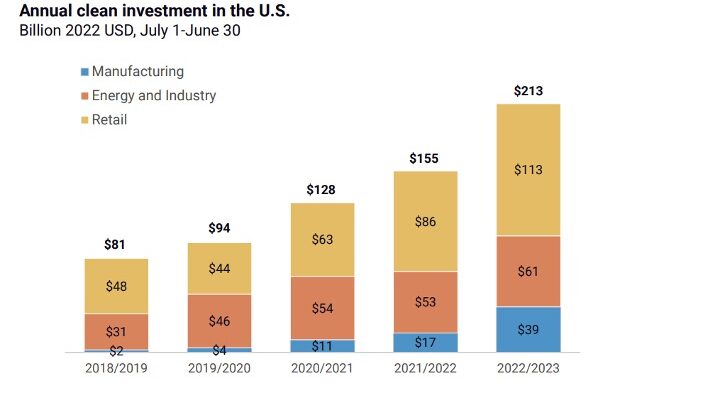

Figure 2 illustrates the outcomes of this initiative, showcasing a substantial $213 billion in verified clean investments across the U.S. from 2022 to 2023. This marks a substantial 37 percent increase compared to the previous year and an impressive 165 percent surge over the total annual investment observed five years ago. Particularly remarkable is the accelerated growth in clean technology manufacturing, which witnessed a noteworthy 125 percent year-on-year increase, amounting to a total annual investment of $39 billion. These trends underscore the tangible impact of the 45X tax credit in driving clean energy investments and fostering growth within the U.S. sector.

Figure 2

Source: Clean Investment Monitor (rhg.com)

IRS Proposed Guidance on Implementation

On December 15, 2023, the U.S. Treasury issued guidance presented in the IRS proposed regulations outlining the qualification criteria and implementation guidelines for manufacturers seeking to use the 45X tax credit. The proposal delineates the potential impact on taxpayers engaged in the production and sale of eligible components, rules related to calculating the credit and specific recordkeeping and reporting requirements.

The proposed regulations could potentially affect eligible taxpayers who produce and sell eligible components and intend to claim the benefit of an advanced manufacturing production credit.

- Definition: Section 45X sought clarification on the definitions of “production” and geographical eligibility of components. The recent Treasury guidance defines eligible production as a “substantial transformation” of raw materials into a different product, excluding “mere assembly” or “superficial modifications” as qualifying processes. Manufacturers can claim credits on separate lines if producing distinct qualifying components independently. The proposed regulations include anti-abuse rules, preventing misuse and discouraging tax-driven production or sale of faulty products to affiliated companies.

- Origin of Inputs: The guidance underscores that eligible components must be manufactured in the United States or territories of the U.S. territories, while the origin of inputs is of lesser importance. The proposed regulations clarify that the domestic production prerequisite does not extend to constituent elements, materials and subcomponents utilized in the manufacturing process of eligible components.

- Timelines: To receive the tax credit, eligible components must be produced in 2023 or later, whilst production could have started earlier than 2023. Credits for solar, wind and storage components phase out after 2029, with reductions starting in 2030 and complete cessation after 2032. Tax credits for processing critical minerals remain permanent.

- Calculating Credit: Unlike fixed-amount credits, the proposed regulations specifically exclude costs associated with obtaining raw materials, focusing on capitalized costs (outlined under U.S. Code § 263A) covering labor, electricity, storage, depreciation, amortization, recycling and overheads. Raw material costs are deliberately excluded to ensure that mere material purchases do not qualify for credit, underscoring the importance of value-adding activities in the production process. Transportation and post-production costs for eligible components or critical minerals are not considered in the tax credit calculation. However, manufacturers may include storage-related expenses, labor, electricity, depreciation and overhead linked to the production of eligible components or minerals.

- Critical Minerals: The guidance outlines eligibility criteria for critical minerals, requiring graphite to be at least 99.9 percent carbon and aluminum (both high-purity and commercial-grade) to be at least 99.7 percent aluminum. To simplify verification for tax credits under Section 45X, secondary production of “commodity-grade aluminum” is excluded. The tax credit calculation for critical minerals depends on 10 percent of production costs, excluding certain costs like direct or indirect material expenses. This aims to credit costs that enhance mineral value while avoiding multiple credits for the same costs. Notably, purchasing raw materials alone is not considered a value-adding activity.

Caveats

Given the competitive nature and limited funding of the Section 48C advanced energy project investment tax credit, companies may be looking to Section 45X to compensate for unmet demand. Unlike Section 48C, which offers an upfront tax credit based on capital investment, Section 45X operates as an uncapped per-unit production tax credit.

The proposed regulations establish the interaction between Section 48C and Section 45X, specifying that eligible components must be produced at a Section 45X facility, explicitly excluding property included in a Section 48C facility. A Section 45X facility is defined as tangible property forming an independently functioning production unit generating one or more eligible components. Importantly, manufacturers cannot claim the 45X tax credit for products produced at a facility where they already claimed a Section 48C credit post-Inflation Reduction Act (IRA) enactment.

Shortcomings of 45X Guidance

The proposed guidance on the 45X tax credit appears to fall short in incentivizing and strengthening local critical mineral and electrode active mining as well as related advanced manufacturing capacity. This shortfall is largely attributed to the exclusion of raw material costs from the credit calculation and a lack of specificity or restrictions on where these materials can be imported from. Consequently, companies and taxpayers engaged in critical mineral production may not welcome the exclusion of costs related to the domestic extraction or acquisition of raw materials.

Treasury’s guidance, which introduced new definitions such as “substantive transformation” as production qualifiers, is also criticized for its vagueness and deviation from the statutory definitions included in the IRA. This raises concerns about its apparent conflict with the enacted statutes. Furthermore, taxpayers anticipating a credit based on production costs may find the exclusion of direct and indirect material costs impactful, considering the term was previously undefined. The provided guidance appears to exhibit inconsistencies with the statutory framework, potentially impeding the seamless and effective implementation of the tax credit.

The tax credit is intended to serve as a crucial catalyst, motivating producers, investors and taxpayers to channel their efforts into domestic manufacturing. However, 45X does less to regulate the import of minerals and inputs, undermining the goal for a supply chain free from Chinese dominance or other inefficient markets. In its current form, the guidance proposed for the Section 45X tax credit may not be sufficient to contribute significantly to the development or enhancement of local critical mineral capacity. This raises questions about the tax credit’s effectiveness in achieving the intended goal of fostering self-reliance in producing essential minerals.

Conclusion

Section 45X serves as a crucial catalyst, motivating producers, investors and taxpayers to channel their efforts into domestic manufacturing. However, the tax credit does less to regulate the import of minerals and inputs, undermining the goal for a supply chain free from dominance by Chinese or other inefficient markets. In its current form, the guidance proposed for the Section 45X tax credit may not be sufficient to contribute significantly to the development or enhancement of local critical mineral capacity. This raises questions about the tax credit’s effectiveness in achieving the intended goal of fostering self-reliance in producing essential minerals.

Moving forward, it is imperative the guidance becomes more specific in its regulations for minerals mining and importing of materials, maintaining a focused perspective of its impact on domestic markets and smooth implementation in the United States.