Introduction

Hydrogen has been dubbed the “Swiss army knife” of clean energy, given its potential to become a tool to cut emissions in key sectors, as well as to assert U.S. global energy leadership and increase our nation’s competitive edge. According to the U.S. Department of Energy (DOE), switching to low-emissions hydrogen in hard-to-abate sectors could reduce U.S. CO2 emissions by up to 10 percent from 2005 levels by 2050. Currently, hydrogen is a feedstock for the production of ammonia (the main building block for agricultural fertilizers), methanol, and oil refining. It has the potential to greatly reduce emissions in hard-to-decarbonize industrial applications such as steelmaking, cement manufacturing, trucking and aviation, as well as power generation and energy storage. Growth in the U.S. hydrogen market is also estimated to result in an additional 27,000 jobs by 2030.

The United States has natural advantages for hydrogen production because of its ample availability of feedstocks, storage, and adaptable natural gas supply infrastructure. Hydrogen production is also supported through key programs such as the Regional Clean Hydrogen Hubs, whose awardees were announced on October 13, 2023. Another element that will be crucial for developing a market for clean hydrogen are tax incentives put in place in 2022, when Section 45V of the tax code was codified creating a ten-year production tax credit for clean hydrogen. The United States has the potential to become a global leader in the sector – if producers can properly capitalize on these incentives and rapidly scale up the hydrogen industry.

The 45V production tax credit (PTC) is tiered based on the lifecycle emissions of the hydrogen production process utilized. Clean hydrogen production relies either on electricity, which may be generated through renewable or fossil fuel resources; or directly on fossil fuels, via steam methane reformation (SMR) or coal gasification accompanied by carbon capture, or via methane pyrolysis. As a result, the carbon emissions of hydrogen production can vary depending on the process used. Table 1 below illustrates the range of the credit value available.

| Lifecycle GHG Emissions (kg CO2e/kgH20) | PTC Value ($/kg H2) |

| 2.5-4 | $0.60 |

| 1.5-2.5 | $0.75 |

| 0.45-1.5 | $1.00 |

| 0-0.45 | $3.00 |

Source: Incentives for Clean Hydrogen Production in the Inflation Reduction Act (rff.org).

Hydrogen Production and Challenges

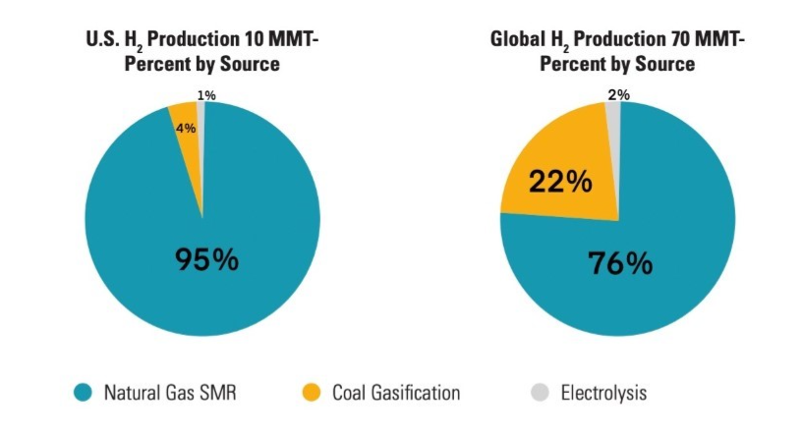

In 2021, the U.S. produced 11.4 million metric tons (MMT) of hydrogen, or 15 percent of global hydrogen production, mostly via SMR (see Figure 1). Currently, most clean hydrogen production in the U.S. is limited to pilot projects. DOE’s National Clean Hydrogen Strategy and Roadmap sets a target of increasing U.S. clean hydrogen production to 10 MMT by 2030 and 50 MMT by 2050 to achieve a 10 percent reduction in domestic greenhouse gas emissions.

Figure 1. U.S. and global hydrogen production by source.

Source: U.S. DOE, Hydrogen Strategy: Enabling a Low-Cost Economy, p. 5, USDOE_FE_Hydrogen_Strategy_July2020.pdf (energy.gov).

According to one estimate, the U.S. has the resource base – i.e., ample reserves of low-cost natural gas, abundant low-cost renewable resources in certain regions, and abundant geologic storage – to produce up to 1 billion metric tons of clean hydrogen. It is also a resource that pairs well with our existing industrial infrastructure and workforce capabilities. Many professions employed in the industrial and fossil fuel sectors, such as civil and electrical engineers, or legal and regulatory roles, will be key to supporting the growth of a hydrogen industry. Existing enabling infrastructure may include gas pipelines, transportation networks, and CO2 storage resources. Given this potential, hydrogen is one of the most promising pathways toward decarbonizing our economy and boosting America’s competitiveness in a world that increasingly values cleaner production. However, achieving this level of production requires overcoming a series of technical and financial challenges.

- Transportation. Pipelines are the most cost-efficient method for transporting large gas or liquid volumes, but there is a limited amount of dedicated hydrogen pipeline infrastructure in the country. Building new pipelines involves high capital costs, necessitates large-scale offtake certainty, and presents permitting challenges. It is possible to adapt existing natural gas pipelines to transport hydrogen, but this requires some reconfiguration, as hydrogen is corrosive to some metals, which can cause embrittlement of steel pipelines. Codes and standards will have to be developed for pipelines to transport hydrogen safely, accounting for embrittlement and the fact that it is highly flammable. In addition, increased fossil fuel use for hydrogen production may require additional pipelines to transport carbon dioxide to authorized sequestration sites if the CO2 is not reused for enhanced oil or gas recovery, or in the production of higher value chemicals or products.

- Siting and permitting. Currently, the operation of a hydrogen pipeline involves oversight by various federal agencies and a patchwork of federal statutes and regulations. As with oil pipelines, there is no single lead agency with centralized federal siting authority over hydrogen pipelines. To construct new interstate pipelines, developers require siting approvals from each implicated state. Pipelines that transport hydrogen blended with natural gas are likely to fall under FERC’s authority, but the precise percentage of hydrogen that can be blended into these pipelines is unclear. Under the current permitting process for infrastructure, however, new energy projects can take years, or even decades, to get approved. This makes construction of new pipelines extremely difficult, and lawsuits can lead to decades of regulatory limbo for many energy projects.

- Cost parity. The cost of producing hydrogen may vary widely by feedstock, region, and electricity generation mix, depending on resources and infrastructure available. Cost parity between the various sources and production methods is a key factor in the development of a hydrogen marketplace. Without incentives, hydrogen production with natural gas is typically cheaper than via electrolysis with renewable energy, even if it includes carbon, capture, utilization, and storage (CCUS). Section 45V would reduce production costs for all production pathways (in a scenario where they all qualify), although there is uncertainty as to how much these costs might decrease for each technology. Reducing the cost of production is a critical component of enabling demand, as otherwise, stakeholders might not have incentive to risk switching to clean hydrogen. Additional investment in transportation and storage infrastructure will also be key in scaling hydrogen operations and reducing costs.

Uncertainty Surrounding 45V

Clean energy tax credits approved in 2022 and incentives from the Infrastructure Investment and Jobs Act (IIJA)[RC1] aim to significantly reduce costs for clean hydrogen production in the coming years. Timelines for achieving cost parity will vary across sectors, but programs such as DOE’s Regional Clean Hydrogen Hubs and the 45V tax credit will be crucial to creating economies of scale and lowering costs.

When 45V was announced, many investors and companies interested in developing clean hydrogen projects began making decisions with the availability of this credit in mind. However, given the general uncertainty surrounding clean energy tax credits and the delay in the release of Treasury guidance on 45V, some companies had temporarily paused or canceled projects, waiting for clear and certain information on what to expect.

On Friday December 22, 2023, the U.S. Treasury Department released a draft of the much-anticipated guidance with a Notice of Proposed Rulemaking (NPRM). Reactions to the draft guidance are split, just as opinions were prior to its release. Environmentalists favor strict guidance that would limit emissions from hydrogen production from the start, while utilities and many hydrogen producers argue more flexibility is required for a hydrogen economy to get off the ground. The proposed rule is currently under a comment period with a deadline of February 26, 2024, and a public hearing regarding the guidance will be held on March 25, 2024.

The “Three Pillars”

Much of the guidance, as well as the regulatory debate surrounding it, has centered around three elements that are meant to ensure that produced hydrogen is indeed low-emissions on a lifecycle emissions basis: additionality (also called incrementality), deliverability, and time-matching, often termed the “three pillars.”

Additionality or Incrementality

Incrementality refers to a requirement that would ensure electricity used for hydrogen production comes from low- or zero-emissions sources. The intention is to prevent electrolyzers from drawing on renewable sources that would otherwise feed the grid[RC1] , which some fear would necessitate more fossil fuel electricity production (based on the current fuel sources used for grid electricity).

The proposed guidance stipulates that the facility generating electricity for hydrogen production cannot begin commercial operation more than 36 months before the hydrogen production facility is placed in service. Under certain circumstances, existing electricity generation may also satisfy the incrementality requirement, such as:

- Facilities that make certain upgrades, such as fossil fuel-based electricity generating facilities that add CCS capabilities, provided this was done within the 36-month period.

- Facilities that are “uprated” (meaning an increase in nameplate capacity) within those 36 months.

- Existing power generation plants that make other improvements, provided they meet the “80/20 test” – namely, that the value of the used property does not exceed 20 percentof the facility’s total value.

The proposed incrementality requirements have elicited concern from stakeholders intending to use nuclear and hydroelectric generation to produce hydrogen. As written, they would not allow existing nuclear or hydropower assets to qualify for the credit, and these types of facilities take years –sometimes decades– to permit and construct. It is also worth noting that this requirement as it currently stands is more stringent than that adopted by the European Union, which allows a phase-in period, with incrementality not kicking in until 2028.

Treasury is, however, seeking comments on other pathways that might satisfy the incrementality requirement, and which would allow the use of existing power plants, such as:

- Electricity generation facilities that avoid retirement because of their association with a hydrogen production plant.

- Electricity generators that demonstrate zero or minimal induced grid emissions through modeling. Generators might prove, for example, that the renewable electricity used would otherwise be curtailed, or that generation in the region is from minimally emitting sources and that an increased load would not have an effect on emissions.

- A formulaic approach, whereby 5 percent of hourly generation from low-emitting generators placed in service before January 1, 2023, could be used. This would avoid the complications involved in modeling, but some have raised concerns that emissions and costs from this pathway could prove too high, depending on the time that this 5 percent is used.

Deliverability

Deliverability seeks to ensure that electricity-based production obtains clean energy from local sources to circumvent potential electric transmission congestion issues.

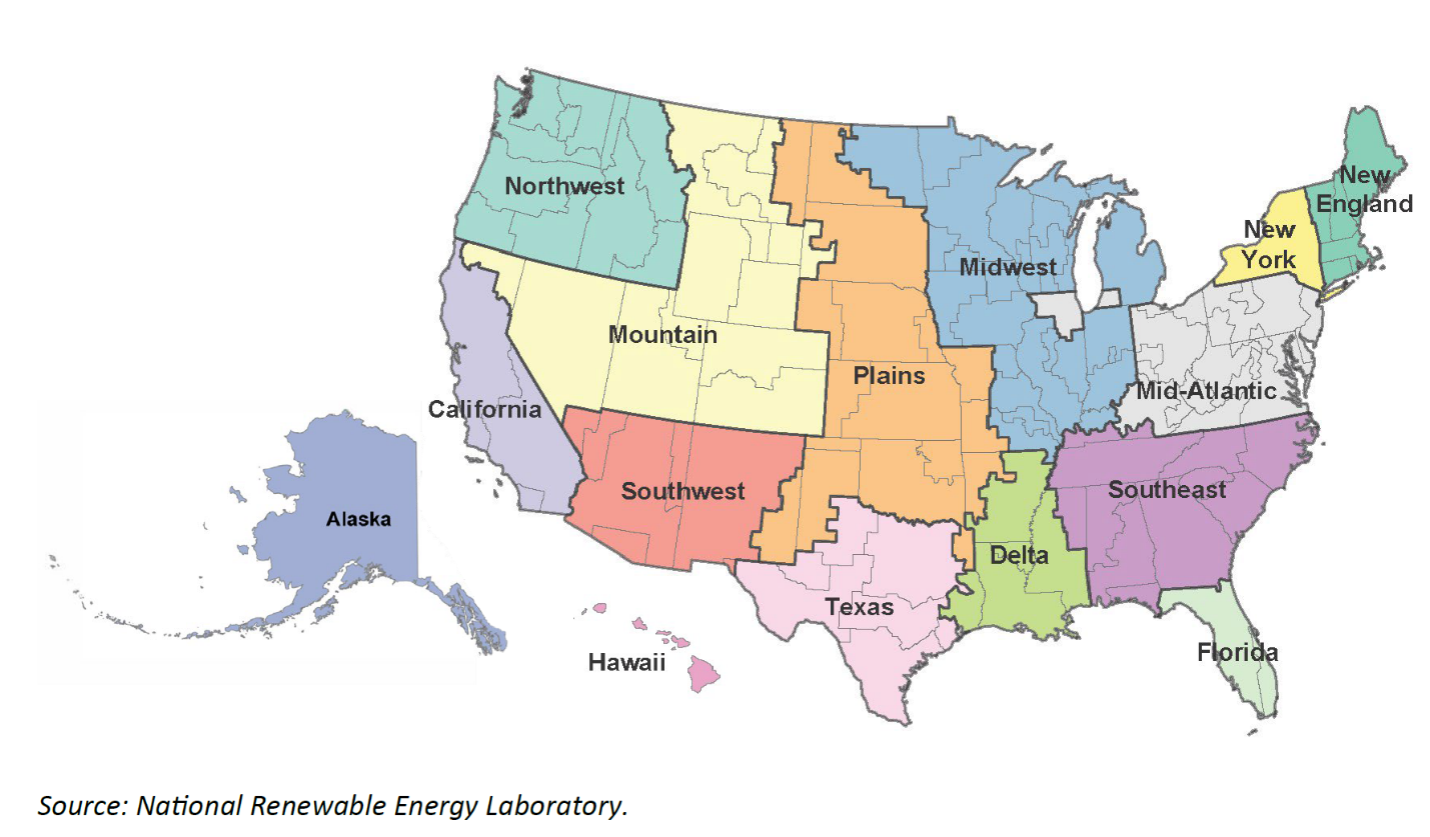

There was not much controversy over this pillar, and the draft guidance did not include anything unexpected. It specifies that electricity used should be obtained from the same region (as defined in DOE’s 2023 National Transmission Needs Study – see Figure 2) as the hydrogen production facility.

Figure 2. Regions considered for the deliverability requirement.

Source: National Transmission Needs Study (energy.gov)

Temporal Matching

Temporal matching seeks to ensure that the amount of renewable power put on the grid “matches” the amount of power consumed by hydrogen production so that said production does not increase emissions. There has been much debate about what time period to require matching for.

This was perhaps the most debated pillar of the three. Prior to the draft guidance’s release, there was some concern that adhering to a strict requirement of hourly matching could significantly raise costs and negate the benefits of the 45V credit in many cases, in addition to the current lack of nationwide hourly generation tracking systems, which could slow the scaling-up of hydrogen production.

The draft guidance proposes a transitional period for phasing in hourly matching, whereby annual matching would be allowed for electricity generated before January 1, 2028. The guidance landed on a requirement that avoids the strictest option of requiring hourly matching on day one, although more stringent than the most flexible approach of limiting requirements to annual matching. In relation to hourly tracking systems, Treasury specified that they conducted a survey of existing tracking systems, and that most gave a timeline of at most five years to be able to develop an hourly tracking functionality.

Anxiety from Industry

Environmentalist groups have praised the guidance, but several industry stakeholders have voiced concern that the rules will discourage hydrogen investment and cause delays in the deployment of hydrogen technologies. Various stakeholders in DOE’s hydrogen hubs are worried that the economics will not pencil out for them, and some projects have been paused or canceled, given that there is still uncertainty of how the final version of the rule will shake out. A week before the release of the draft guidance, for example, the natural gas company CNX Resources pulled out of an ammonia project that is part of the Appalachian Regional Clean Hydrogen Hub, citing uncertainty over the credit. Companies need clear guidelines before making decisions to invest in production as well as in the ancillary infrastructure needed to transport, use, or export that hydrogen.

Regarding temporal matching, concerns remain that requiring all hydrogen producers to switch to hourly matching by 2028 is too accelerated a timeline. This phase-in period is shorter than the guidelines adopted by the European Union, which will not implement hourly matching until 2030, with monthly matching in place until then. Some have also suggested that facilities beginning construction before 2029 should be able to remain on annual matching for the life of the facility (also called “grandfathering”). The Clean Hydrogen Future Coalition, a group of utilities, project developers, and energy and oil companies, published a statement rejecting any additionality requirements and arguing that matching should be annual until 2030 and monthly thereafter.

Even some voices from the European Union have also advised against rules that are on the stricter end of the spectrum. Speaking at the Hydrogen Transition Summit held during COP28 on December 7, 2023, for example, Jorgo Chatzimarkakis, CEO of Hydrogen Europe, counseled the United States to not adopt hourly correlation, which he equated with an unrealistic “electolyzer-only” strategy with costs that would prove far too high. He predicted that under this regime, hydrogen investments would divert to Europe, Australia, or other regions.

With regards to additionality, some posit that the fear of electrolyzer production displacing clean grid electricity might be overblown. Although some have raised concerns that electrolyzer production using grid electricity could have a relatively high emissions profile (depending on the electricity mix and location), our grid is rapidly decarbonizing. While there will be regional differences, and while transmission and storage limitations remain an issue, the EIA has projected that over the next two years, most of the new generation added to the grid will come from zero-emissions sources. By 2050, the EIA expects that the share of renewables in U.S. electricity generation will grow from 21 to 44 percent.

Section 45V is a production tax credit geared to incentivize production of hydrogen. This means that the investment decision needs clear guidelines before companies can not only invest in production, but in the ancillary infrastructure needed to export or use that hydrogen.

So What Now?

The 45V clean hydrogen PTC will be crucial to de-risking hydrogen enough for commercial entities to give serious consideration to switching to hydrogen. Reduced costs are expected to spur investment that will lead to innovation, with the goal of hydrogen technologies becoming competitive on their own in the market. For this to happen, however, Treasury guidance on their implementation should adopt a balanced approach that ensures hydrogen will be an effective decarbonization tool, while also not placing too many constraints that could delay uptake by industry. While there is some concern that adopting more flexible guidelines could lead to higher emissions in the short term, the broader call from industry seems to be that it needs more time to scale-up clean hydrogen production sufficiently for it to become cost-effective without a subsidy.

For example, not allowing nuclear or hydroelectric-based production to qualify for 45V would cut out essential, reliable generation technologies. Nuclear generation on its own is the largest source of zero-emissions generation in the United States. Policies should arguably focus on advancing clean hydrogen in a manner that is agnostic to supporting technologies. Hydrogen producers should also be provided with the certainty that the hydrogen PTC will be in place for the ten-year period it was planned for.

Finally, meaningful permitting reform will be a key enabler of a U.S. hydrogen economy. Whether related to the construction of hydrogen pipelines, storage facilities or other supportive infrastructure, maintaining the current process could mean costly delays in getting the industry off the ground.

Ensuring that we create a hydrogen production industry that effectively reduces more emissions than it creates is crucial to our decarbonization path, and the 45V PTC should provide support for innovation in clean hydrogen technologies that could be key pathways to reducing U.S. CO2 emissions. However, this will not be accomplished if the industry is hamstrung before it gets up and running. Treasury guidance for 45V should certainly put forth meaningful and effective guidelines, but their implementation should be sufficiently gradual and flexible.

Given that the hearing regarding the draft guidance is scheduled for March 25, 2024, we will likely not see a final version of the rule before April, with stakeholder anxiety poised to stew until then.