With domestic electricity demand expected to rise after years of relatively flat demand, offshore wind is a largely untapped domestic resource that can provide significant clean electricity generation.i Offshore wind plays an important part in an all-of-the-above approach to energy generation and is poised to create economic benefits across the country.

Background on U.S. Offshore Wind

As of December 2024, the U.S. has three offshore wind energy projects in operation, but U.S. offshore wind energy generation is expected to increase substantially in the coming years.ii Offshore wind offers a unique value proposition as it can provide power to populated coastal areas experiencing high electricity demand without requiring long-distance transmission.iii Offshore wind generation also operates at a higher capacity factor than onshore wind, which means these turbines can produce significantly more electricity.iv As offshore wind projects are typically located on the federal Outer Continental Shelf (OCS), the federal government plays a key role in project development. Siting offshore wind requires a lease from the Bureau of Ocean Energy Management (BOEM) at the U.S. Department of the Interior (DOI).

Economic and Jobs Benefits of Offshore Wind

CRES Forum commissioned Louisiana State University’s Center for Energy Studies (LSU-CES) to assess the economic impacts of scenarios for a National Offshore Wind Build-Out for the U.S. economy. The report, “Potential Economic Implications of Offshore Wind for the U.S. Economy”, shows that the economic and job benefits of offshore wind are substantial.v The paper outlines both the economic implications over the next decade as offshore wind projects continue to be built out, as well as the economic implications once the industry is fully operational.

Key Findings of the LSU Report

The report considers two build-out scenarios. The first uses data from the 2023 Annual Energy Outlook (AEO) produced by the U.S. Energy Information Administration, and the second build-out scenario utilizes the 2023 Standard Scenarios Report by the National Renewable Energy Laboratory (NREL). Below are the key results of the report:

- By 2050, the AEO and NREL Scenarios, respectively, project that 23 GWs and 52 GWs of offshore wind capacity will be constructed in the U.S.

- Over the next decade, OSW construction is estimated to support an average of at least 43,000 to over 80,000 total jobs per year in the respective scenarios. Construction is estimated to add $34.4 billion to $78.7 billion in Gross Domestic Product (GDP).

- Once the offshore wind projects are fully operational, an estimated 33,000 to 73,000 jobs will be supported nationwide annually. This is estimated to support $1.9 billion to $4.3 billion in earnings per year, and $3.3 billion to $7.4 billion of GDP per year.

While the AEO scenario provides a more conservative estimate than the NREL scenario, both scenarios demonstrate that the continued build-out of U.S. offshore wind offers significant opportunities for growth in domestic electricity generation and job creation.

Offshore Wind Generates New Job Opportunities

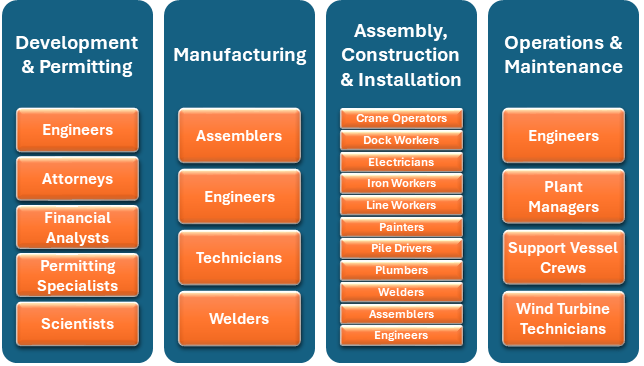

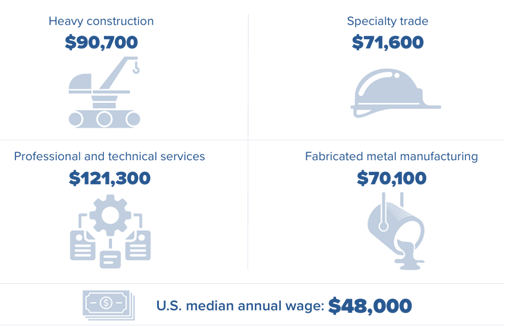

Offshore wind energy projects are complex and require a well-trained workforce across a range of sectors.vi As highlighted in the LSU report and by the U.S. Bureau of Labor Statistics, jobs in offshore wind yield much higher earnings than U.S. median annual wages.vii

Offshore Wind Development Phases & Direct Job Types Supportedviii

Average Annual Pay of Selected Jobs in the U.S.ix

Offshore Wind & Domestic Industries

There is a unique nexus between the jobs, expertise, skills and capabilities in existing domestic industries required for offshore wind development. This is particularly clear for workers and businesses that specialize in offshore oil and gas, maritime trades, ports and shipbuilding work.

- Offshore Oil and Gas: Workers in the offshore oil and gas sector play an important role in offshore wind construction, as they have unique expertise with offshore operations, including working in harsh marine environments, managing complex machinery and understanding safety protocols, which makes skills relevant and applicable to offshore wind development.

- Maritime: Crews from traditional maritime jobs can find opportunities in operating and maintaining service operation vessels or crew transfer vessels that are essential for transporting technicians to and from wind projects. They have many transferable skills such as navigation, safety and engineering.

- Ports: Port infrastructure is crucial for the staging and assembly of wind turbine components. Offshore wind deployments increase demand for port workers skilled in logistics, heavy machinery operation and material handling. Aside from essential traditional cargo handling functions, ports can acquire capabilities as specialized facilities for wind turbine logistics, thereby generating jobs in site management, storage, and coordination of large-scale components.

- Shipbuilding: The need for specialized domestic vessels is already catalyzing growth in shipbuilding. This not only creates direct employment in constructing these vessels but also in their design, maintenance and eventual retrofitting or decommissioning, offering a range of roles from welders and engineers to naval architects.

U.S. Flagged Offshore Wind Vessel Investments to Date

Shipbuilding provides tremendous economic investment and is happening all over the country. As of November 2024, there are roughly 45 U.S. flagged offshore wind vessels investments. Below is a list of U.S. flagged offshore wind vessel investments, by state of construction, including Crew Transfer Vessels (CTV), Service Operation Vessels (SOV), Fast Support Vessels (FSV), Wind Turbine Installation Vessels (WTIV), a Cable Laying Vessels (CLV) and multipurpose vessels, tugs and barges.x

To learn more, please see American Clean Power, “Offshore Wind Investments in U.S.-Flagged Vessels” for the most up to date list of builds by company, location, shipyard and manager.

Investments to Date in U.S. Flagged Offshore Wind Vessels

| State | Build/Retrofit Location | Vessels Type & Status |

| Connecticut | Bridgeport | 2 CTV – In Service |

| Florida | Palatka | 2 CTV – Under Construction 4 CTV – Ordered 1 CTV – In Service |

| Jacksonville | 2 CTV – In Service | |

| Panama City | 1 SOV – Under Construction 1 SOV – In Service | |

| Louisiana | Houma | 2 Barges – Ordered 1 SOV – Under Construction 1 SOV – In Service |

| Unknown | 1 CTV – Under Construction 1 SOV – In Service | |

| Franklin | 1 CTV – In Service 1 CTV – Under Construction | |

| New Iberia | 1 CTV – In Service | |

| Massachusetts | Somerset | 1 CTV – Under Construction 1 CTV – Ordered |

| Michigan | Onaway | Multipurpose – Ordered |

| Mississippi | Gulfport | 2 Tug – Ordered |

| Pennsylvania | Philadelphia | Rock Installation – Under Construction |

| Rhode Island | Warren | 4 CTV – In Service 2 CTV – Under Construction |

| North Kingstown | 5 CTV – In Service 1 CTV – Under Construction | |

| Providence | 1 FSV – In Service | |

| Texas | Brownsville | WTIV – Under Construction |

| Virginia | Norfolk | 1 FSV – In Service |

| Washington | Platypus Marine | 1 CTV – Ordered |

| Anacortes | 1 SOV – In Service | |

| Wisconsin | Sturgeon Bay | 1 SOV – Under Construction |

| Unknown | To Be Announced | 1 CLV, 1 CTV – Ordered |

Vessel Investment: Ørsted and Shipbuilder Edison Chouest

In 2024, Ørsted and Shipbuilder Edison Chouest christened the first-ever American-built, offshore wind service operations vessel. More than 600 workers across three U.S. Gulf states built a “Floating Home Base” for offshore wind technicians supporting Ørsted’s northeast wind farms.xi

Offshore Wind & Domestic Supply Chains

Building a resilient domestic supply chain is necessary for offshore wind development, as massive blades, turbines and components will be needed at scale. Job creation and economic growth catalyzed by supply chain investments are already being realized not just in coastal communities, but nationwide. This manufacturing opportunity for workers and communities will only grow with the continued development of a domestic supply chain. Research by NREL shows that a domestic supply chain that can supply 4-6 GW of offshore wind projects per year will likely require private investment of at least $22.4 billion in ports, large installation vessels and manufacturing facilities.xii To establish a supply chain by 2030, NREL estimates that manufacturing facilities will drive investments of $3.5 billion for wind turbines, $1.3 billion for substructures, $1.8 billion for electrical components, $3.5 billion for installation vessels, $8 billion for ports, $3 billion for steel plates and $1.3 billion for manufacturing facilities for other components. Support vessels, workforce training and supporting supply chain expansion are expected to drive further investments.

Supply Chain Investment: Nexans – Charleston, South Carolina

In Charleston, South Carolina, Nexans operates a one-of-a-kind high voltage subsea cable plant that supplies the expanding U.S. offshore wind market. When opened in 2021, the facility created 210 direct new jobs and many indirect jobs locally through the development of the supply chain and support for the offshore wind industry.xiii

Federal Policy Proposals to Unlock Offshore Wind Benefits

Deploying offshore wind offers significant advantages, including bolstering domestic energy production and resilience, fostering job creation and driving economic growth. To fully realize the benefits of offshore wind, federal policies can provide certainty for investors and promote the expansion of the domestic offshore wind supply chain. Here are a few immediate federal policy items related to offshore wind for Congress and the Administration to consider:

Permitting Reforms to Accelerate Energy Deployments

The current federal permitting system is antiquated and broken – it takes on average 4.5 years for an energy project to get the required permits needed to build a project.xiv Delays negatively affect the economy—interfering with project timelines, vessel contracts and expectations for domestic suppliers, jeopardizing job creation and reducing economic activity.

Federal permitting reform offers an opportunity to accelerate the deployment of energy projects including offshore wind. While there are many federal permitting reform proposals introduced in recent years, legislation that streamlines the National Environmental Policy Act (NEPA) process, improves interagency coordination, reduces process redundancy and decreases opportunities for frivolous litigation would be most beneficial to offshore wind development.

Offer Predictable Federal Leasing to Encourage Investment

BOEM is responsible for holding lease auctions for offshore wind on the Outer Continental Shelf and is experiencing strong interest in additional offshore wind energy development.xv Acquiring a lease is an important step to develop an offshore wind project but to be viable, developers also need to ensure construction can be completed and that necessary transmission can bring the power generated online.xvi To improve investment certainty, it’s crucial to establish a transparent leasing schedule, akin to what is effective for the oil and gas sectors. Offering predictable offshore wind lease sales allows developers and suppliers to plan with foresight, reducing investment risk. Increasing predictability of lease auctions streamlines the investment decision-making and aligns it with the long-term financial commitments required for large-scale renewable projects.

Revenue Sharing Programs to Support Coastal Communities

Nearly 40 percent of Americans live in coastal countiesxvii which face challenges related to increasingly frequent and severe floods and storms as well as erosion. Revenue sharing legislation can support U.S. coastal community resilience and ensure coastal states receive a fair share for development and production off their coasts to meet the growing need for coastal restoration, hurricane protection, infrastructure improvements and more. Current law requires all revenues generated from offshore wind leases and production in state waters to be deposited in the U.S. Treasury. Legislative proposals for revenue sharing seek to amend this requirement and send a percentage of offshore wind revenue to adjacent states where offshore wind farms are developed – this includes coastal states as well as those surrounding the Great Lakes.

Conclusion

As the U.S. looks to meet growing demand for electricity, offshore wind offers tremendous potential as a significant driver for economic growth and job creation. The nexus with existing offshore oil and gas, maritime sector, shipbuilding and ports creates new opportunities for these industries to leverage their expertise to develop domestic supply chains, grow the economy and bolster domestic energy dominance and security. To realize the full potential of offshore wind, federal policy actions can accelerate energy deployments, encourage continued investment and strengthen coastal communities that host offshore wind. Offshore wind energy represents a strategic opportunity for the U.S. to advance its clean energy goals while simultaneously boosting economic development and creating good paying jobs.