Summary

The Chinese Communist Party (CCP) leverages its industrial capacity to crush foreign competition in trade, as well as predatory investment and loans, to control global supply chains and create overseas markets that serve its goal of commercial dominance. Much of the world, including America and its allies, buys the CCP’s products and services, as well as provide food and raw materials that feed and power the country’s massive population and industrial base. In the developing world, China’s infrastructure projects aim to reinforce its standing as the “world’s factory” by anchoring those economies to its own.

The CCP’s neo-colonialism1 in sub-Saharan Africa and Latin America fortifies its geopolitical position, which creates substantial risks to America and its allies. Much of the U.S. manufacturing base and its ability to meet basic U.S. defense and consumer needs is dependent on China. Moreover, the CCP is working diligently to reduce U.S. influence; it has invested roughly $900 billion globally in energy and agricultural projects – in part to improve the competitiveness of non-U.S. production and reduce American relative economic power in those sectors.

In this competition for influence, America does not have an equivalent menu of policy options available as compared to the CCP and its state-owned enterprises (SOEs). While U.S. policymakers have tools to constrain or prevent Chinese acquisition of domestic land and industry, America has limited means to block Chinese action abroad. And unlike Beijing, Washington cannot absorb the risks faced by its companies when investing in parts of the world that are plagued by a multitude of governance problems. Nor can U.S. firms engage in the type of corruption from which Chinese firms benefit when circumventing environmental, safety, and labor standards.

America and its allies need to think creatively on how they can leverage their combined market power to preserve their rules-based international order, which the CCP is determined to repeal and replace with its own design. In curtailing Chinese relative dominance, focus should be given to creating a new trade paradigm that holds China accountable for its poor environmental, human rights, and labor record. In this pursuit, America should also work closely with emerging markets and developing countries – many of which are suffering from stagnation and deindustrialization because of Chinese trade and investment practices – in strengthening their own political and economic development, as well as energy security.

A carefully crafted, American-led trade policy is needed, which would reward Western performance and efficiency, increase investments in U.S. and allied-controlled supply chains, and reinforce the competitiveness of U.S. and other producers who frequently face unfair competition resulting from Chinese economic policies. Such a trade policy should also bolster environment and conservation laws and enforcement in the developing world, which would help restrict Chinese economic penetration and diminish the advantages gained by the CCP over the previous few decades.

Understanding Economic Trends

Introducing the Belt and Road Initiative

Although China’s neo-colonialist march began before its entry into the World Trade Organization (WTO) in 2001, it has accelerated since Chinese President Xi Jinping’s announcement of the Belt and Road Initiative (BRI) in 2013.2 For the past decade, China has aggressively invested in infrastructure projects to facilitate trade and deepen international ties to advance its commercial position. Like the ancient Silk Road on which the premise was inspired, BRI aims to create efficient physical transportation routes to move goods in and out of China by land and by sea – with a particular focus on developing economies in Southeast Asia, Africa, and Latin America.

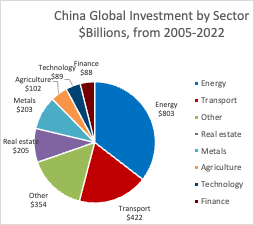

Data Source: American Enterprise Institute and Heritage Foundation, China Global Investment Tracker

China has plunged the largest share of its overseas investment in the energy sector, bringing power plants, grid development, and transmission lines to both developing and developed nations.3 Since 2005, it has funded over $800 billion in renewable and non-renewable energy projects, of which approximately $350 billion has gone to BRI members.4 Other sectors of substantial investment include real estate, metals, and agriculture.

Since its inception, nearly 150 countries have joined the BRI,5 including 21 in Latin America and the Caribbean and 43 in sub-Saharan Africa. Over half of its member countries joined between 2017-2018 with more announced each year.6 For example, Argentina officially declared its involvement in a joint statement with China last year.7

Official BRI status is not a prerequisite, nonetheless, for the CCP’s investment and trade engagement. Brazil, for example, is not an official member, but it has received $76 billion in investment since 2005 – the most of any country in Latin America and the bulk of which went toward energy projects.8 Despite the recent evidence of a slowdown in infrastructure investments due to COVID-19 and the resulting economic fallout,9 China has spent approximately $1 trillion on BRI projects in the past decade.10

Trends in Trade11

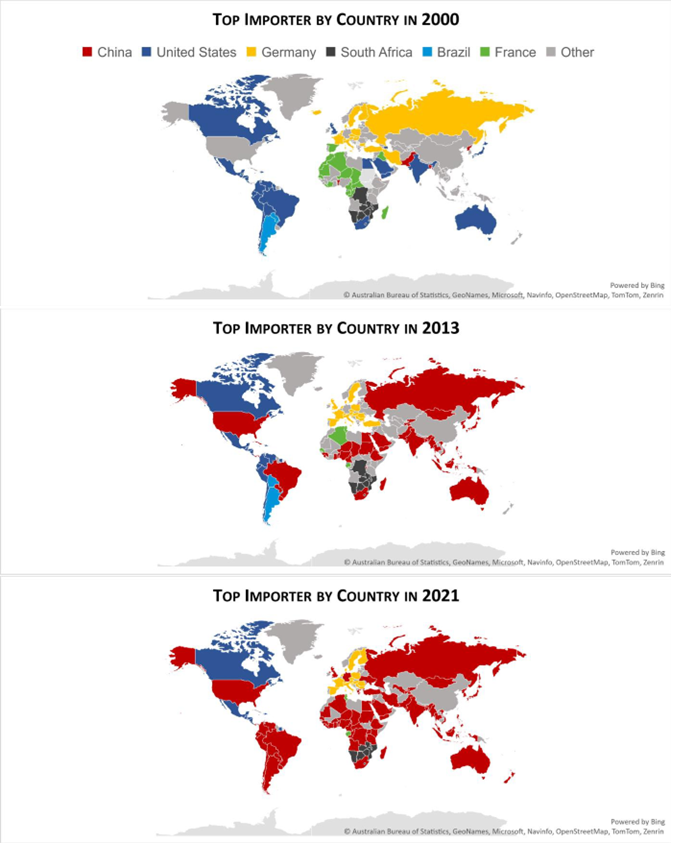

With energy and transportation infrastructure in place and expanding, the CCP’s dominance of global supply chains is intensifying through its growing trade with the developing world. As of 2021, China had become the number one importer in 28 sub-Saharan African countries and 11 Latin American countries, representing a considerable shift in only 8 years, when the rankings were 16 and 5, respectively.

Globally, the dramatic rise of China’s export dominance since its WTO entry and BRI rollout can be seen in the maps on the next page. In 2000, China’s ranking as top importer fared modestly against other major economies, winning the highest spot in only a handful of countries. By 2013, it had captured approximately 50 countries, including some major economies such as America, Australia, Brazil, Russia, and South Africa. After a decade of intense infrastructure investments under BRI, China had gained the top importer rank in almost all of South America and large swaths of Africa, reducing the once dominant global economic presence of America and its Western allies.

Except for some small island nations in the Caribbean, America has not gained the top importer ranking in any country at least since 2000, and it has lost its relative trade dominance in over 25 countries, primarily to China. Some of those losses include Australia, Brazil, India, Japan, South Africa, and the United Kingdom.12 This phenomenon, however, is not only impacting America. Brazil, for example, was once the top exporter to neighbors Argentina and Paraguay, while French dominance in Francophone Africa has shrunk considerably to only a few countries. While this paper does not examine whether China is displacing trade at the product level, the general pattern of the CCP’s expanding trade dominance is clear – growing dependency on Beijing that in turn, reduces U.S. and allied commercial influence.

Trade Balances with China13

While the BRI intends publicly to enhance a “two-way” partnership, most countries in Latin America and sub-Saharan Africa run significant trade deficits with China. In Latin America, the trade imbalance has grown from $56 billion in 2013 to $78 billion in 2021. Mexico’s trade deficit soared to $74 billion that year, compared to $52 billion the year before. The region’s total trade deficit was offset largely by Brazil’s trade surplus, topping $34 billion in 2021. China’s high demand for soybeans and iron ore accounted for $56 billion of the $88 billion it imports from Brazil.

Sub-Saharan Africa follows a similar pattern, as its trade deficit with China swelled from $2 billion in 2013 to $31 billion in 2021. Nigeria’s trade deficit climbed to $19 billion, but was counterbalanced by Angola’s $18 billion surplus, derived almost entirely from its crude petroleum exports. The region’s expanding trade relationship with China stands in stark contrast to its diminishing commercial ties with America. Its total trade activity with America peaked in 2008 at $103 billion and has since trended downward to $43 billion in 2021, whereas its total trade with China climbed from $86 billion to $182 billion over the same period.

While the aggregate numbers indicate the direction and volume of trade, a closer look at the product details reveals the neo-colonial nature of China’s commercial relationship with the developing world. Tables 1 and 2 list the top 6 exports and imports from America and China to Latin America and sub-Saharan Africa. As these tables indicate, China generally imports commodities and then exports manufactured goods. In contrast, America’s trade with these regions is more balanced in that it provides both energy and food resources that improve the importer’s economic security.

Increased commodity trade generally creates economic growth in rural areas. When trade crowds out investment in labor-intensive industries in urban areas, however, it can inhibit rural-urban migration as a pathway for economic development. It is widely recognized that China’s growth miracle depended on rural-urban migration, which provided the necessary labor force for more industrial production.14 While Chinese investments have clearly created jobs in rural areas, job growth is inhibited by the SOE practice of bringing in their own workers. There were officially roughly one million Chinese workers employed overseas in 2019, with many additional others working overseas on tourist visas or in other unofficial capacities.15

The CCP’s growing dominance in developing and emerging markets creates an increasing risk of economic stagnation in urban areas, which slows down migration from rural to urban areas.16 Brazil and South Africa, for instance, have both experienced relative deindustrialization, which is largely caused by competition from Chinese imports.17 18 This current trade dynamic is good for the CCP as it undermines potential foreign competition. Nonetheless, it presents political-economy challenges for developing countries as migration to cities generally improves access to cleaner water, more reliable food stocks, and better education and health care. Impediments to movement can also leave a population more vulnerable to environmental impacts and natural disasters as rural areas typically suffer from a relative lack of government services.19 In a worse-case scenario, failure to expand economic opportunities in urban areas that can then absorb rural population growth can produce political instability and violence.

Table 1: Top 6 USA and China Exports and Imports to Latin America & Caribbean (LCN) excluding Mexico

(In Billions of $U.S. Dollars in 2021)

| USA Exports to LCN excluding Mexico | China Exports to LCN excluding Mexico | |||

| Product Description | $Bil | Product Description | $Bil | |

| Refined Petroleum | $35.9 | Telephones | $11.3 | |

| Petroleum Gas | $9.7 | Computers | $7.0 | |

| Vaccines, blood, antisera, toxins & cultures | $4.7 | Semiconductor Devices | $3.6 | |

| Crude Petroleum | $3.8 | Coated Flat-Rolled Iron | $3.5 | |

| Ethylene Polymers | $3.1 | Vaccines, blood, antisera, toxins & cultures | $3.1 | |

| Corn | $3.1 | Other toys | $3.0 | |

| USA Imports from LCN excluding Mexico | China Imports from LCN excluding Mexico | |||

| Product Description | $Bil | Product Description | $Bil | |

| Crude Petroleum | $12.3 | Iron Ore | $33.2 | |

| Refined Copper | $6.8 | Copper Ore | $33.2 | |

| Gold | $4.4 | Soybeans | $29.2 | |

| Medical Instruments | $4.0 | Crude Petroleum | $17.6 | |

| Coffee | $3.9 | Refined Copper | $8.1 | |

| Semi-Finished Iron | $3.8 | Frozen Bovine Meat | $7.3 |

Data Source: BACI HS17 (2017-2021)

Table 2: Top 6 USA and China Exports and Imports to Sub-Saharan Africa (SSF)

(In Billions of $US Dollars in 2021)

| USA Exports to SSF | China Exports to SSF | |||

| Product Description | $Bil | Product Description | $Bil | |

| Cars | $1.9 | Telephones | $4.2 | |

| Petroleum Gas | $1.1 | Passenger and Cargo Ships | $2.6 | |

| Wheat | $0.8 | Rubber Footwear | $2.5 | |

| Vaccines, blood, antisera, toxins & cultures | $0.7 | Synthetic Filament Yarn Woven Fabric | $2.5 | |

| Motor vehicles; parts & accessories | $0.5 | Coated Flat-Rolled Iron | $2.3 | |

| Poultry Meat | $0.5 | Refined Petroleum | $2.2 | |

| USA Imports from SSF | China Imports from SSF | |||

| Product Description | $Bil | Product Description | $Bil | |

| Platinum | $6.9 | Crude Petroleum | $28.5 | |

| Crude Petroleum | $5.0 | Refined Copper | $5.5 | |

| Cocoa Beans | $1.0 | Gold | $5.0 | |

| Cars | $0.8 | Diamonds | $4.7 | |

| Diamonds | $0.7 | Cobalt | $4.5 | |

| Gold | $0.7 | Iron Ore | $3.6 |

Data Source: BACI HS17 (2017-2021)

Examining Domestic Impacts of Chinese Neo-Colonialism

Most Washington-based discussions related to Chinese foreign economic policy have centered on U.S. manufacturing and trade, intellectual property theft, and acquisition of U.S. land and industry, as well as industrial espionage. There is also growing awareness of a potential debt trap related to opaque Chinese financing of BRI projects in the developing world, providing opportunities for Beijing to convert commercial infrastructure to overseas military use (e.g., Sri Lanka’s Chinese-built port of Hambantota).

Since the COVID-19 pandemic, supply chain concerns have driven bipartisan interest in how American economic security is affected. The negative impacts on U.S. domestic interests are sometimes subtle because they can have a significant, indirect effect on a narrow band of U.S. businesses and stakeholders. This section looks at two objectives of Chinese neo-colonialism, specifically at the CCP’s quest to dominate global mineral supply chains and its often-overlooked focus on bolstering food security. These two goals affect America very differently – one aims at increasing Western dependence on China while the other seeks to diminish China’s vulnerability, largely in relation to America. Successfully achieving both would reduce the hazards to Beijing of conducting economic warfare with the West.

Mineral Resources

Much has been written about Beijing’s industrial policy pertaining to strategic and critical minerals. To the casual observer, the CCP’s efforts to lock up long-term foreign supplies might suggest that the country is poor in those resources, but that is not the case. China is wealthy in minerals, but not enough to meet its ambitious decades-old commercial goal to dominate worldwide trade in key technologies, in addition to ensuring its own energy security. In gaining global supremacy in mineral resource extraction and processing, China seeks to secure its role as the world’s factory and expand the economic and political influence that standing provides.

Within its own territory, China currently dominates much of the production of key minerals, per the below table.

Table 3: Production of selected minerals

| U.S. % | Chinese % | Russian % | Other | |

| Aluminum | 1% | 57% | 5% | 36% |

| Cobalt | 0% | 1% | 4% | 94% |

| Copper | 4% | 38% | 4% | 54% |

| Lithium | – | 14% | – | 86% |

| Nickel | 1% | 4% | 9% | 86% |

| Selenium | – | 37% | 10% | 53% |

| Tellurium | – | 59% | 12% | 29% |

| Zinc | 6% | 32% | 2% | 60% |

| Rare Earth Elements | 15% | 60% | 1% | 24% |

Source: USGS Mineral Commodity Summaries 2022, https://pubs.er.usgs.gov/publication/mcs2022.

China has reinforced its edge in domestic mineral production by extending control of overseas mining interests, which has given it considerable control over the upstream global supply chain.20 It has achieved this result by leveraging its ability to absorb political and economic risks when funding projects in the developing world that would be considered too risky for Western governments and private-sector players. Many poor countries are beset with corruption, internal conflicts and internal rivalries, human rights abuses, lack of property rights, and weak governance – problems that complicate efforts to secure international financing. The CCP has taken advantage of their lack of financial resources by offering cheap loans for strategic projects. These economic activities bolster Chinese political influence in the developing world at the expense of Western interests, given the long-term nature of those investments.

Over the past few decades, for instance, the CCP has worked diligently to gain greater control of African mineral resources. In 2000, there were only two Chinese-controlled projects and operating mines in Africa.21 By 2010, the total had grown to 15, and within eight years, it had expanded to 27. While total control is less than 7% of the sum of African value of mine production, its production dominance of certain key minerals is troublesome, per the below table.22

Table 4: Chinese Controlled Production of Selected Minerals in Africa (2018)

| Chinese-controlled Production in Africa (Millions of U.S.$) | Total African Production (Millions of US$) | Chinese Controlled Share of African Production (%) | |

| Copper | 2,902 | 10,300 | 28 |

| Bauxite | 1,318 | 1,600 | 82 |

| Cobalt | 901 | 2,200 | 41 |

| Gold | 544 | 30,600 | 12 |

| Zinc | 226 | 780 | 29 |

| Uranium | 163 | 400 | 40 |

Source: RMG Consulting.

Chinese controlled mines in Africa and elsewhere ship their production back to China for mineral processing, thus establishing a dependence on CCP-owned infrastructure and denying those countries the ability to gain further economic value from their own resources in global supply chains. While developing countries are beginning to push back with export restrictions and requirements to process at home, the lack of domestic capital will still necessitate foreign partnerships, including with Chinese SOEs.23

This CCP foreign economic policy has enabled it to capitalize fully on its long-term strategy of investing in its own domestic processing, which has allowed China to create a dominant midstream market position.24 While China only produces 14% of the word’s lithium, for example, it controls 80% of global refining capacity through its state-owned industry.25 In the case of cobalt, it accounts for 1% of global production and 64% of the world’s refining, compared to the Democratic Republic of Congo’s share of 68% of the mineral’s production with only 0.1% of its refining.26 Similarly, China produces 9% of the world’s copper output yet controls 37% of the refining capacity.27

Because America and its allies lack sufficient refining capacity for minerals, they must send most of their own raw material production to China for processing before their use in manufacturing the technologies that require them. This creates a further comparative advantage for Chinese industry in the downstream part of the global mineral supply chain – the final process in the production and sale of goods to consumers. The CCP’s non-market industrial planning has been particularly aided by its abuse of WTO rules,28 as well as the market signals created by mandates and subsidies in the developed world for low-carbon technologies.

While China’s strategy has been incredibly successful from a CCP perspective, it has resulted in environmental degradation, deforestation, and pollution across the developing world.29 China’s mining bauxite in Ghana, for instance, risks tainting water for 5 million people and threatens roughly 43,000 acres of protected forests.30 According to Human Rights Watch, the CCP’s SOE mining in Guinea damaged farmlands and water sources, and its sand mining in Mozambique contributed to a flood that partially destroyed a village.31 Similarly in Latin America, almost all Chinese-funded projects in the region have contributed to deforestation and water pollution, as well as human rights violations, according to the Collective on Chinese Financing and Investments, Human Rights and the Environment (CICDHA), a coalition of conservation and human rights groups.32

Besides the environmental impact of Chinese operations, labor and health regulations have been ignored or circumvented, thanks in part to SOE corruption practices. A McKinsey report from 2017 found that 60% to 87% of Chinese firms had paid a “tip” or bribe as part of their activities in Africa.33 In Kenya, less than 50% of Chinese companies had employment contracts for all their employees, compared to 100% of U.S. firms.34 These SOE labor abuses result in safety violations and inhumane working conditions, as noted by Human Rights Watch in their analysis of Chinese copper mines in Zambia.35 By exploiting and enabling existing corruption behavior in the developing world, China bolsters its unfair advantage and undermines the ability of U.S. and Western companies to operate. Beijing not only absorbs the political and economic risks of its SOEs in poor regions of the world – it also creates conditions that increase those risks for U.S. and other Western investors.

The scope of Chinese strategic and critical mineral investments in sub-Saharan Africa and Latin America increases the CCP’s power and influence over global supply chains and raises concerns over the ability of America to meet its basic defense and consumer needs if a Sino-American economic or military conflict were to break out and escalate. Dependence on mineral supply chains controlled by China is a major vulnerability for Western security, and it could very well undermine the ability of countries to achieve emissions reductions goals that depend on existing low-carbon technologies. In the past, the CCP has expressed willingness to embargo mineral exports or use its market power to penalize foreign nations that disagree with it.36

U.S. industry, which has already struggled with COVID-related supply shocks, is very much aware of the political and economic risks associated with increased U.S.-China tensions. Achieving greater economic security, however, will take time as the CCP’s dominance of supply chains (upstream, midstream, and downstream) cannot be easily circumvented for the foreseeable future.37 For many U.S. companies hoping to remain competitive in global markets, they must maintain or even seek new partnerships with Chinese industry out of necessity as they work to reshore or friend-shore key components of the supply chain.38 Importantly, their ability to achieve diversification will at least in part depend on U.S. permitting and regulatory reforms that allow for greater extraction of domestic resources and increased U.S. refining and processing capacity.

Food Resources

Chinese foreign economic policy is shaped by the country’s past, including the Great Famine of 1959-1961, which resulted in roughly 30 million deaths.39 China’s traditional food security strategy, which is anchored in self-sufficiency, has been forced to adapt to exploding food consumption as standards of living have increased and arable land has fallen because of climate change and conversion to urban use.

The CCP clearly has a food security problem that it must manage. China ranked 34th out of 113 countries in the 2021 Global Food Security Index;40 while the country has 21% of the world’s population, it only enjoys 7% of its productive farmland.41 Chinese growth in agricultural commodity consumption has outpaced its domestic supplies, forcing a growing reliance on imports – potentially placing the country in a precarious position relative to America.42 Tensions with Washington have driven the government to diversify away from U.S. farm imports, especially soy,43 resulting in greater efforts to develop non-U.S. agricultural supply chains, chiefly in Latin America. Shifting to Brazilian soy and beef has become the CCP’s primary focus in the region, and most of that production rests in the Amazon and the tropical savanna region, which accounted for 70% of Chinese imports of Brazilian meat in 2017.44

Chinese state-owned companies are buying up overseas farmland. Between 2011 and 2020, the CCP obtained roughly 17 million acres around the world, compared to U.S. company purchases of about 2 million acres.45 Beijing is also building infrastructure to enhance access to overseas agricultural markets with the goal of lowering the cost of delivery to China.46 Such improvements also enhance the relative competitiveness of non-U.S. agricultural production. In Brazil, Beijing has designated two BRI deals related to transmission and port expansion and expressed interest in a third – a railway project that would reduce transport costs by 40% and cut delivery rates by weeks.47 While Chinese investors retreated from those projects largely for economic reasons related to COVID-19, Brazil’s most recent elections are likely to spark new interest as the former Bolsonaro administration was vocal in its criticism of China.48

Achieving the CCP’s food security goals trumps any concerns over environmental degradation and growth in greenhouse gas emissions. Beijing’s increased interest in Latin American food production and the pull of the Chinese market has incentivized rain forest destruction, much of it illegal as China has looked the other way. In Brazil, Nicaragua, Colombia, and Bolivia, cattle ranching is the primary cause of forest loss and degradation,49 and about 80% of deforested areas in the Amazon have been converted to cattle pastures, much of it in preparation for soy production.50 In 2021, there was continued forest loss with Brazil, Colombia, and Bolivia ranking in the top ten countries with the highest deforestation.51 Importantly, deforestation is responsible for around 15% of global greenhouse gas emissions, and 40% of the world’s tropical deforestation is caused by illegal activity.52

Although many countries have laws limiting illegal deforestation, they are often not enforced effectively due to lack of resources, the absence of political will, and corruption.53 Such illegality includes land-theft, unauthorized land-clearing, criminal deforestation, and encroachment on protected forest areas. For example, between 2013 and 2019, 81% of the land cleared to raise cattle in Brazil was illicitly deforested,54 and unlawful ranching was the cause of more than 90% of deforestation in five Central American countries.55 According to recent research, as much as 60% of beef exported from Brazil to EU markets is linked to illegal land-clearing as defined by Brazilian law.56 When cattle products from unlawfully deforested areas enter the global beef market, additional crimes – such as using fraudulent documentation and giving bribes to local officials – are often involved, which increases public health risks for importers.57

Even though these facts are well known in America and abroad, foreign cattle ranchers and companies responsible for illegal deforestation are rarely prosecuted or punished in their home countries. Their ability to avoid regulation and turn unlawfully deforested land into farmland for free essentially subsidizes the production of cattle and provides an unfair advantage over U.S. producers, layered on top of the increased competitiveness provided by Chinese infrastructure investments.

These developments impact the attractiveness of U.S. soy and beef products in third markets, as well as threaten to undercut the competitiveness of U.S.-produced goods in the American market.58 America’s beef sector produces some of the highest quality beef in the world – including in terms of lifecycle greenhouse gases – because of American innovation and high U.S. standards. Most other countries, including those in Latin America, do not have the same stringent, science-based regulations, and foreign cattle companies often comply with significantly weaker rules.

The U.S. import market for cattle products is significant. U.S. purchases of beef, hides, and other cattle products total over $1 billion annually just from countries in Central and South America. In 2020, America imported $507 million in cattle products from Brazil and $327 million from Nicaragua.59 Since a ban on Brazil’s beef imports was lifted in February 2020, America has become the second-largest importer of Brazilian beef behind China.60 Because the European Union recently imposed strict regulations on importing products from deforested land,61 62 U.S. producers may face an increased risk of dumping of illegally-sourced products on the U.S. market. Thus, American farmers and ranchers may face an even tougher playing field that directly and indirectly flows from China’s food security policies.

Creating a New Trade Paradigm

In the case of industrial and supply chain security policy, China is decades ahead of the West.63 America and its allies cannot beat China in a subsidy war of attrition as Beijing has a relative unlimited supply of financial resources that enable it to endure protracted costs for long-term gains, as well as a menu of “subsidy” options unavailable to Western governments, including but not limited to relaxing environmental enforcement or utilizing forced labor camps. Reshoring key components of the minerals supply chain will undoubtedly require substantial and meaningful U.S. permitting and regulatory reforms. Furthermore, the maintenance and preservation of U.S. supply chain security will necessitate a new trade policy designed to protect those public and private sector investments designed to enhance it. U.S. policymakers should expect the CCP to leverage its market power in global trade to neutralize or destroy attempts to revitalize U.S. industry or decouple America from China.

Strengthening U.S. economic security will also depend on significant innovation that marginalizes existing Chinese chokepoints in the supply chain that America cannot easily overcome. As Turkish control of medieval trade routes between Europe and East Asia sparked the Age of Exploration, U.S. entrepreneurs must seek, for example, opportunities to create substitutes for minerals that are controlled by the CCP or create new technologies that make Chinese production methods antiquated. The U.S. government should encourage this innovation by partially underwriting it, but more importantly, it should avoid interference, such as unnecessary regulations, that thwarts it. The strategic benefits of a smart, effective federal supply chain policy would certainly outweigh its costs to consumers and taxpayers.

Notably, America cannot play the same game as Beijing in many parts of the developing world as Washington cannot absorb the risks facing U.S. foreign investment that are worsened by Chinese activities promoting overseas corruption. Moreover, unlike CCP-controlled interests, U.S. companies cannot turn a blind eye to poor labor practices or environmental degradation that is tied to their operations. Unfortunately, the current global trade regime allows China to monetize its activities with little control of the associated pollution and exploitation of deprived communities at home and abroad.

In the case of overseas environmental degradation caused by China’s demand for agricultural commodities, America has even fewer existing policies designed to effectively counter this dark side of the CCP’s neocolonialism. Western policymakers have long struggled to address the challenge of tropical deforestation, and their capacity to develop solutions using decades-old tactics (e.g., carbon offset and debt swap programs) is increasingly limited by China’s commercial footprint, as well as the enormity of the Chinese market, which can process and consume commodities at a level beyond any other individual country.

A new trade regime could offer America and its allies a strategy to curb China’s ability to convert its industrial planning and neocolonialist activities into an economic advantage. Because of the size and pull of the Chinese economy, a common approach leveraging the combined market power of the West is necessary. By itself, America only accounts for 13% of total global merchandise imports,64 but a G7-plus grouping65 would cover roughly 50% of imports, compared to about 12% for China.66

This new trade and supply chain framework could rely on a few different approaches or a combination of them to fortify U.S. and more broadly Western economic security. Goals, however, should be grounded in economic reality as there will be multiple cases where America and its allies possess limited or no present capacity to extract or manufacture certain products. This challenge could be addressed with exemptions or a glidepath to encourage investments in innovation and production to achieve U.S. strategic objectives.

Leveling the Regulatory Playing Field

America could adopt a trade policy that requires imports to meet the same environmental and labor standards as domestic economic activity or face an import fee or potential ban.67 This differs from a conventional tariff in that the exporter could avoid the fee if it met U.S. standards. One could calculate the economic cost of the regulations that U.S. companies face in production and then impose that same cost as a fee on imports from countries that lack equivalent policies.68 Of course, verifying both the “equivalency” of policies and effective enforcement of these policies would be difficult at best, and cheating would be very onerous to both detect and remedy. In addition, a domestic political agenda could conflict with the imposition of penalties leading American government officials to be lax in its pursuit of enforcement. A simpler approach could simply block imports that are produced in a way that would be illegal under U.S. law and regulations (e.g., minerals produced with forced labor).69

These policies could theoretically help level the playing field for U.S. domestic producers who are required to meet these standards and disrupt the trade advantage that Chinese and other exporters get from their unfair and immoral “subsidies.” American companies that import these products would then be incentivized or required to shift to other suppliers or invest in substitutes.

Additionally, America, in coordination with its allies, could also leverage the West’s market to enforce existing regulations in the exporting country. Many of these laws were adopted because of U.S. and allied foreign legal assistance, but they have not been enforced effectively for a variety of reasons – some of which include corruption or lack of governmental resources. Significantly, the failure of America and other governments to enact their own domestic policies that are consistent with the importer’s laws complicates the ability of those developing countries to enforce their own rules. For example, current U.S. trade policy pertaining to Brazilian beef is not focused on preventing trade in commodities produced on illegally deforested land.

America could follow the lead of its European allies to restrict imported commodities originating from illegally deforested land.70 While this type of action would not block the CCP from incentivizing the conversion of tropical forests for agricultural use, it would put greater pressure on Beijing not to turn a blind eye to related unlawful activity. Moreover, it would help protect U.S. domestic producers from facing unfair competition in their own market.

U.S. and allied regulatory action could also include mandatory country of origin labeling and scores related to upholding environmental, labor, and human rights standards. Consumers would then know where their products originate and could make informed decisions as to how to use their purchasing power. But this would require a very stringent and reliable mechanism to ensure the country of origin was not simply a pass-through as has been alleged recently with solar panels and China.

Rewarding Environmental Performance

U.S. and allied economies are much more carbon efficient than China, meaning they produce the same or similar goods while emitting less carbon dioxide. Traditionally, market based, competitive economies reward efficiency through increased margins and thus result in more efficient production (lower emissions) than socialist or government-controlled economies that carry little reward for efficient production. A well-designed trade policy could leverage this efficiency into a competitive advantage in global trade and help promote reshoring and friend-shoring activities across the supply chain.

The below table indicates that America and its allies hold an efficiency advantage over China in the upstream production of agricultural, forestry, and mining commodities.

Table 5: America’s carbon efficiency compared to select U.S. allies and China, agriculture, forestry, and mining sub-sectors in commodities

| United States | European Union | Canada | China | |

| Agriculture, Forestry, and Fishing | 1.0 | 1.2 | 1.4 | 1.2 |

| Mining and Quarrying of Non-Energy Producing Products | 1.0 | 0.8 | 1.6 | 2.2 |

| Mining Support Services | 1.0 | 1.9 | 1.5 | 5.2 |

| Food Products | 1.0 | 0.8 | 1.0 | 1.4 |

| Wood and Products of Wood | 1.0 | 0.9 | 1.3 | 1.8 |

>1.0 indicates a U.S. advantage; <1.0 indicates a U.S. disadvantage. Data is from 2015. Source: Climate Leadership Council, 2020, https://clcouncil.org/reports/americas-carbon-advantage.pdf.

Likewise, the next table shows an efficiency advantage for U.S. and allied producers over China in selected manufactured products, reflecting a downstream advantage as well.

Table 6: America’s carbon efficiency compared to select U.S. allies and China, agriculture, forestry, and mining sub-sectors in Manufactured Products

| United States | European Union | Canada | China | |

| Paper Products | 1.0 | 0.8 | 1.0 | 1.7 |

| Fabricated Metal Products | 1.0 | 0.9 | 0.9 | 3.1 |

| Computer, Electronic, and Optical Products | 1.0 | 2.1 | 2.3 | 5.7 |

| Machinery and Equipment | 1.0 | 0.8 | 0.9 | 2.8 |

| Motor Vehicles | 1.0 | 0.7 | 1.0 | 2.4 |

>1.0 indicates a U.S. advantage; <1.0 indicates a U.S. disadvantage. Data is from 2015. Source: Climate Leadership Council, 2020, https://clcouncil.org/reports/americas-carbon-advantage.pdf.

America and its allies could require imports to meet the environmental performance of their own production or pay a pollution fee, based on life cycle emissions. Specifically, a trade framework could be based on a “gate-to-gate” traceability into the supply chain.71 An emissions performance approach would not give any subjective consideration to a country’s policies or regulations, as the embodied emissions in an import would represent the totality of the exporter’s performance, including the efficiency of production, energy sources utilized, as well as its regulatory framework.

If “gate-to-gate” emissions were included to capture CCP overseas operations that result in environmental degradation, final products made in China would face an even higher fee. This initiative would increase the cost to Beijing of its SOE operations in the developing world, thus helping level the playing field for Western companies that maintain higher standards.

Specific to illegal tropical forest deforestation, the emissions performance fee could be informed by the degradation resulting from associated land use changes and conversion to agricultural use. While China would likely ignore those costs, it would help prevent those goods from being dumped in Western markets, thus protecting U.S. and allied producers from unfair competition.

America would also have opportunities to work with large emerging markets. Brazil, for instance, has an economy that is much more carbon efficient than China and is roughly on par with America’s.72 If Brasilia joined Washington’s efforts to hold China accountable for its pollution, Brazil’s industrial infrastructure should attract more capital; it would also provide an opportunity for the country’s companies to recapture foreign market share lost to China.

Notably, this strategy also offers poor economies, which need to improve energy access, a pathway to counter Chinese neo-colonialism and economic dominance and create stronger commercial relations with the West. In deploying cleaner power generation and other low-carbon technologies, developing country firms would hold a more competitive position against less efficient Chinese imports. It would also encourage investment in value-added industry in those regions. Building a new paradigm should help reset global economic development and create increased “healthy” growth opportunities for poor countries. Moreover, if it were pursued in a way that maximizes carbon efficiency, it would serve as an effective means in avoiding or reducing global emissions – an achievement that has eluded the international community for decades.

Conclusion

Western nations have found themselves at a significant economic disadvantage with Chinese dominance of global supply chains in strategic sectors – upstream, midstream, and downstream. America will need to work closely with its allies and partners to wrest control of critical supply chains from China and counter the CCP’s growing influence in the developing world. By leveraging U.S. and allied combined market power to monetize their environmental performance at the expense of China, which has an economy that is at least three times more carbon intensive than America’s, they can weaken Beijing’s grip and ability to undermine the rules-based international order created by the West after the Second World War.

Creating a new trade policy that holds China accountable for its pollution also offers an opportunity to improve U.S. relations with cleaner, more efficient developing and emerging economies. While U.S. policymakers are aware of the impacts of Chinese trade practices on U.S. and more broadly allied interests, Beijing’s actions have also harmed economic growth prospects in emerging markets and poor countries, creating obstacles to rural-urban migration, undermining efforts to industrialize, and relegating many of those economies to simply providing China the commodities it needs to fuel its economy and feed its population. This situation creates an opening for America to expand its coalition outside of traditional U.S. allies, and in the process, reduce the CCP’s influence.

There will be some economists and academics who will argue that this type of policy shift is not required, pointing to China’s demographic challenge (i.e., shrinking population) and increases in labor costs that will create market forces that naturally drive manufacturing to other countries, which in turn, will diversify supply chains. As part of this process, they point to the likelihood that China will transition to a service economy.

This general outcome, however, is a textbook scenario and does not apply to the CCP, which America should assume will refuse to surrender any of its economic dominance that is linked to its political and military goals. And while China may not be able to totally prevent the emergence of manufacturing centers in other parts of the world, it can create obstacles that leverage its predatory practices to block or crowd out competing investments, thus delaying supply chain diversification.73 Moreover, as a revanchist power preparing for conflict with America and its Asia Pacific allies, the CCP cannot play it any other way. The sooner America internalizes this likelihood, the better.