Introduction

The United States’ agricultural sector is a global leader in productivity while directly producing about 10 percent of the nation’s total greenhouse gas (GHG) emissions. In comparison, both China and India each have almost twice the emissions as the U.S. from their agricultural sectors. Some of this success is owed to the conservation programs administered by the U.S. Department of Agriculture (USDA). These conservation programs support farmers who implement innovative technologies and techniques, and produce their crops efficiently. With the financial challenges of operating a farm, the ability to receive funds for conservation ensures stewardship of invaluable lands while securing our food supply and providing the global market with low-carbon products.

In 2022, over 46 million acres of land (about twice the area of South Carolina) were subject to conservation programs administered by the USDA Natural Resources Conservation Service (NRCS). USDA estimates that the number of farms in the United States has been declining for decades while the spending for major conservation programs has been growing, particularly on working lands.

Conservation programs are typically funded by the Farm Bill, but in 2022, the Inflation Reduction Act (IRA) added funding to NRCS programs with unprecedented technical conditions. Rather than carrying out conservation measures for the sake of responsible land management, farmers now face bureaucratic hurdles in proving their practices are reducing GHG emissions. How IRA funding will affect future funding for NRCS is unknown, but the Farm Bill presents an opportunity to remove these conditions while providing incentives to farmers to use proven innovative practices and improve upon the conservation programs that have contributed to our agricultural sectors’ success.

Background

Every five years, Congress is tasked with passing the Farm Bill. In 2018, Congress passed President Trump signed H.R. 2, the Agricultural Improvement Act of 2018 (PL 115-334), which was slated to expire in September of 2023. However, passage of H.R. 6363, the Further Continuing Appropriations and Other Extensions Act (PL 118-22) provided a clean extension of Farm Bill programs until September of 2024. Among the Farm Bill’s many provisions are grants to farmers and land managers who implement and maintain conservation practices. The goal of conservation is to improve water and air quality, increase soil health, reduce erosion and sedimentation, improve wildlife habitat, conserve groundwater and surface water, and mitigate drought. As a result, the benefits of conservation are broad and far-reaching, and some, even reduce GHG emissions.

NRCS administers various conservation programs, including the Conservation Stewardship Program (CSP), Environmental Quality Incentives Program (EQIP), Agricultural Conservation Easement Program (ACEP), and the Regional Conservation Partnership Program (RCPP). Historically, to take advantage of this funding, farmers must engage in at least one of a long list of practices that qualify for funds, such as managing barnyard runoff, planting cover crops, or providing animals with accessible trails and walkways.

In 2022, the IRA was codified, including its many provisions related to agriculture that are usually included within the Farm Bill. Specifically, the IRA includes authorization for four NRCS programs: CSP, EQIP, ACEP, and the RCPP. However, this authorization comes with new conditions unlike those in any Farm Bill.

In particular, the new conditions make funds available “for one or more agricultural conservation practices or enhancements that the Secretary determines directly improve soil carbon, reduce nitrogen losses, or reduce, capture, avoid, or sequester carbon dioxide, methane, or nitrous oxide emissions, associated with agricultural production.” In short, measurable GHG emissions reductions are necessary for a farmer or land manager to qualify for IRA conservation funding.

Another $1 billion was added to NRCS programs for technical assistance to help farmers with the assessment. NRCS was to use the data collected on carbon sequestration and reduction in carbon dioxide, methane, and nitrous oxide emissions outcomes associated with activities carried out pursuant to this section and track those carbon sequestration and emissions trends through the Greenhouse Gas Inventory and Assessment Program.

The IRA appropriated $3.25 billion in new funding for the CSP for Fiscal Years 2023-2026, and NRCS’s determinations to issue grant funding are based on the dollar amount available for the year rather than an acreage-based goal. While the CSP has allowed farmers to receive funds for multiple years by entering into a contract, upon seeking to renew, they are not simply re-enrolled. Existing grant recipients must compete with new applicants for the annual pool of funds.1 As a result, existing CSP grant recipients would also be subject to the new conditions set out in the IRA to receive those funds.

Mandate in All but Name

The funds provided by NRCS’s programs help farmers to cover the costs of doing business responsibly, which is particularly important when margins are tight and commodities are subsidized. The expenses associated with farming have increased and are forecasted to continue increasing while net income is expected to decrease. According to the USDA’s forecast, in 2023 net farm income will decline by 25 percent when adjusted for inflation.

EQIP and CSP programs are administered by USDA on a state-by-state basis and the number of applications, as well as the percentage approved, varies from state to state. Between 2010 and 2020, Nevada awarded 80 percent of CSP applicants, while Arizona only awarded 5 percent of applicants. Similarly, New Hampshire awarded 57 percent of EQIP applicants, while Arkansas awarded 14 percent of applicants. These values suggest that demand for conservation programs has not been historically met by appropriations.

The existing dependence on conservation programs, as well as the demand, suggests that farmers and land managers have no choice but to adhere to the IRA’s conditions and undergo emissions reporting by way of NRCS technical assistance and consultations. Land unit acreage is used to report the performance of conservation. While the same conservation practice may be employed over many acres, the quantity of carbon dioxide sequestered can vary from one acre to the next based on soil conditions and farming practices. NRCS’s attempts to calculate the unique value attributed to each acre based on soil conditions would be incredibly burdensome while a generalized value for each practice could prove inaccurate.

Established Farming Practices that Reduce GHGs

There already exists much information on organic farming and agroecological practices that result in measurable soil GHG reductions and other environmental co-benefits. Based on these practices, NRCS should redirect the funding for technical assistance to projects that are likely to result in permanent climate smart practices.

For example, perennial agriculture refers to the growth of crops that stay in the ground and produce food across years. Agroforestry refers to the use of woody perennials and agricultural crops or animals on the same piece of land. Perennials store more carbon in the soil than annual crops; land planted with perennial crops generally serves as a carbon sink, whereas land planted with annual crops generally adds greenhouse gases to the atmosphere. Perennial crops more effectively store carbon than annual crops because, unlike annual crops, perennial crops stay in the ground year-to-year and are able to grow deep roots. According to one study, implementing agroforestry in the U.S. alone has the potential to sequester 530 million metric tons of carbon per year. Another study finds that agroforestry can sequester two to five times more carbon per acre than the most promising climate-friendly practices for annual crops.

Federal Spending

The IRA requires the NRCS to offer technical assistance to those farmers and land managers seeking to take advantage of the grant funds. Due to the unique nature of each farm and the wide variety of potential conservation practices, NRCS consults with the farmer on how to best conserve their lands while steering clear of wetlands and highly erodible land violations.

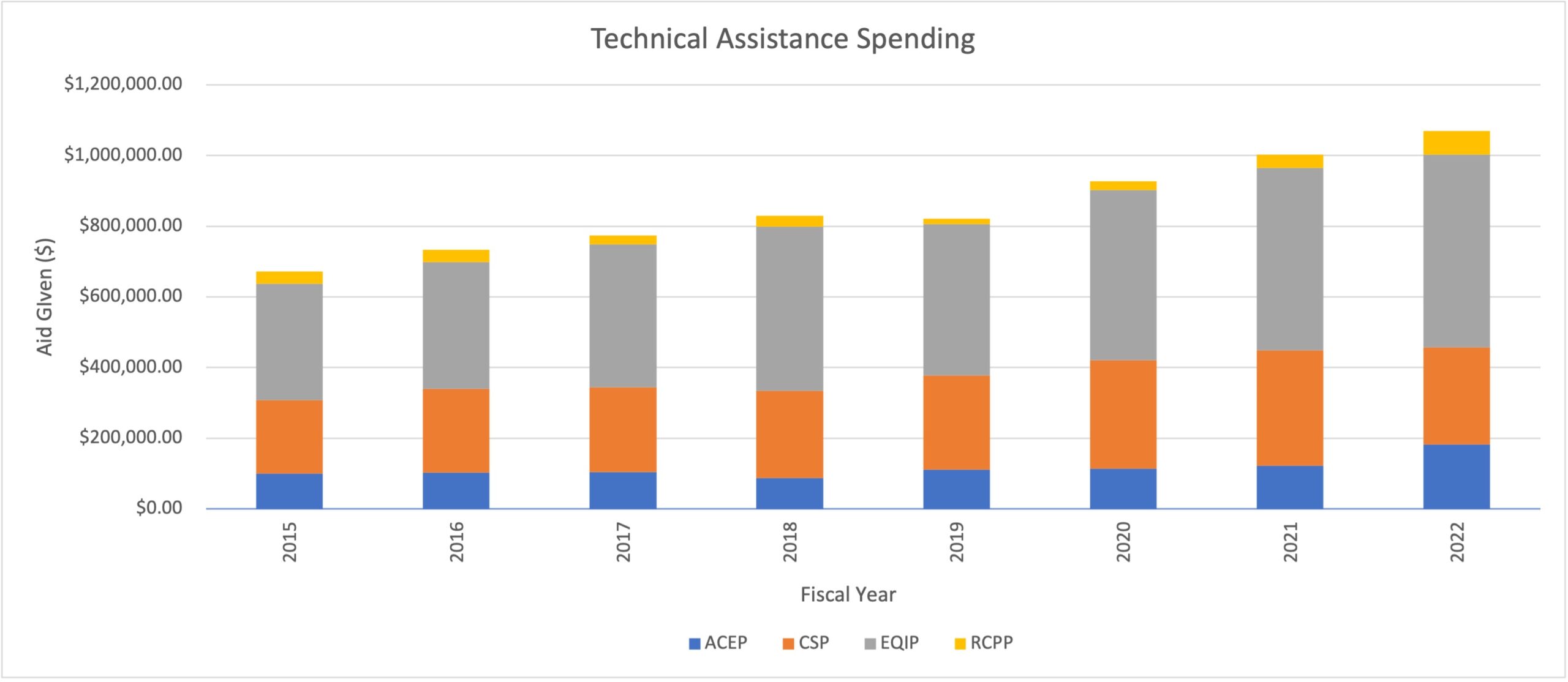

The new emissions-based conditions create an administrative burden by expanding the breadth of technical assistance NRCS is obligated to provide. The IRA authorizes $1 billion to be used by the NRCS to provide conservation technical assistance. These funds are to be used between 2022 and September 30, 2031, an 8-year period. When looking back at the last eight years of financial data available for the four NRCS programs in question, less than $7 million was spent on technical assistance, as illustrated in the chart below. As a result, the authorized sum is 146 times greater than that spent in recent years.

ACEP – Agricultural Conservation Easement Program; EQIP – Environmental Quality Incentives Program: CPS – Conservation Stewardship Program; (RCPP) Regional Conservation Partnership Program (RCPP)

Source: USDA NRCS

Rather than dedicating these funds to procuring technologies and implementing practices that reduce emissions or simply conserve natural resources, $1 billion would be spent on the bureaucratic exercise of identifying which practices reduce emissions on any given farm. Instead, these funds can be used to encourage the adoption of practices that increase efficiency and improve soil health, and thus reduce GHG emissions. Both pilot projects and public-private partnerships incentivize practices and continued investment in smarter, more efficient farms.

Recommendations

In order to continue supporting the valuable work of farmers who engage in conservation practices, the Farm Bill language should:

- Remove the IRA conditions that mandate emissions reductions for NRCS programs and reinstitute conditions from the 2018 Farm Bill;

- Incentivize established conservation practices that reduce emissions rather than mandating emissions reductions; and

- Redirect funds from the IRA’s technical assistance program to support the adoption of innovative equipment and techniques by farmers through pilot programs and public-private partnerships.

Conclusion

The Farm Bill presents an opportunity to improve conservation programs that have recently become defined by political preferences instead of a commitment to conserve agricultural lands. Rather than dedicating funds to creating burdensome reporting requirements for farmers who rely on conservation programs, policies that aid farmers in continuing to adopt innovative technologies and techniques should be implemented. There may be value in establishing GHG reductions and other environmental benefits from organic and agroecological practices, but it should not come at the expense of America’s farmers. By continuing to invest in our agricultural sector, the United States will continue to lead on the production of low-carbon commodities for the global economy.